How quickly the financial landscape can change in just one year!

After 24 months of blissfully easy profits in the “Magnificent 7” tech stocks, 2025 is a year of financial limbo where many investors are still dazed and confused from the beating they took during April’s panic, then failed to profit from the market’s rebound that made up the losses quickly – a classic whipsaw!

It is too soon to tell whether 2025 will be a flat year or just a brief, volatile interruption in a continuing bull market like what we saw in 2020’s powerful reversal.

There have been other “whipsaw” years!

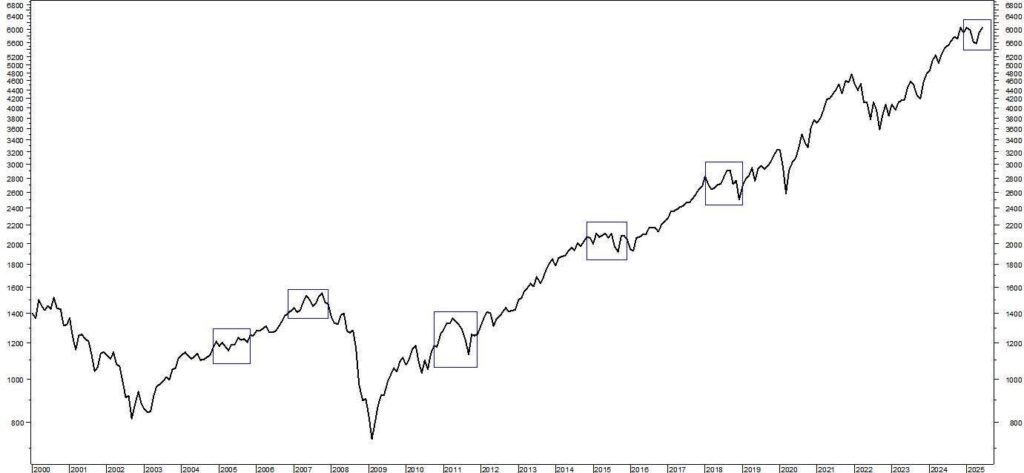

Since 2000, there have been five previous years that produced pitiful year-end stock market returns that were not bear markets: 2005 3%, 2007 4%, 2011 0%, 2015 -1%, 2018 -6% (See chart).

Good News! Excluding 2007’s financial crisis, the following years produced average returns of 16%!

What should investors do?

During stock market whipsaws, it is common for investors to commit the sell low & buy high mistake based on a lack of investment discipline or news headlines.

Here are four tips to help navigate volatile market conditions:

- Trend is your friend – track the 200-day moving average of the S&P 500 Index as well as your investment holdings. If the current price drops below the average, consider raising cash by trimming your winners & selling losing investments.

- Use Market Hedges – When the S&P 500 declines below its 200-day moving average consider adding an inverse market ETF to the portfolio with the aim of effectively hedge against volatile market conditions.

- Become a Stock Picker – During sideways moving markets, new investment opportunities will present themselves. Dull stocks can be very profitable during these market conditions. Look at how steel & alloy industrial stocks like ATI, Carpenter Technologies & Steel Dynamics are outperforming most AI tech stocks like Nvidia & Broadcom in 2025.

- No Pet Stocks – One of my basic investment rules is, “love family & friends – not your stocks!” Many investors blindly hold “never sell” stocks during a volatile correction because of a celebrity CEO, a popular product, or political views. They pay a dear price in investment losses! A favorite stock pet is Apple, which has given up 18 months of gains while the overall market has rebounded in 2025.

There is an old Wall Street saying, “Don’t confuse brains with a bull market.”

As an active money manager with over 30 years of experience, I have learned to pivot quickly to market conditions using these tips to great effectiveness. Whipsaw years are a great opportunity for investors to review their investment strategies and make adjustments

Read the full article here