In the complex world of finance, risk is an inherent factor that accompanies every investment decision. Understanding risk is crucial to making informed choices that lead to financial growth and wealth creation. This guide explores the different types of risks, strategies for risk management, and the overall importance of a balanced approach to investment.

What is Risk in Wealth Creation?

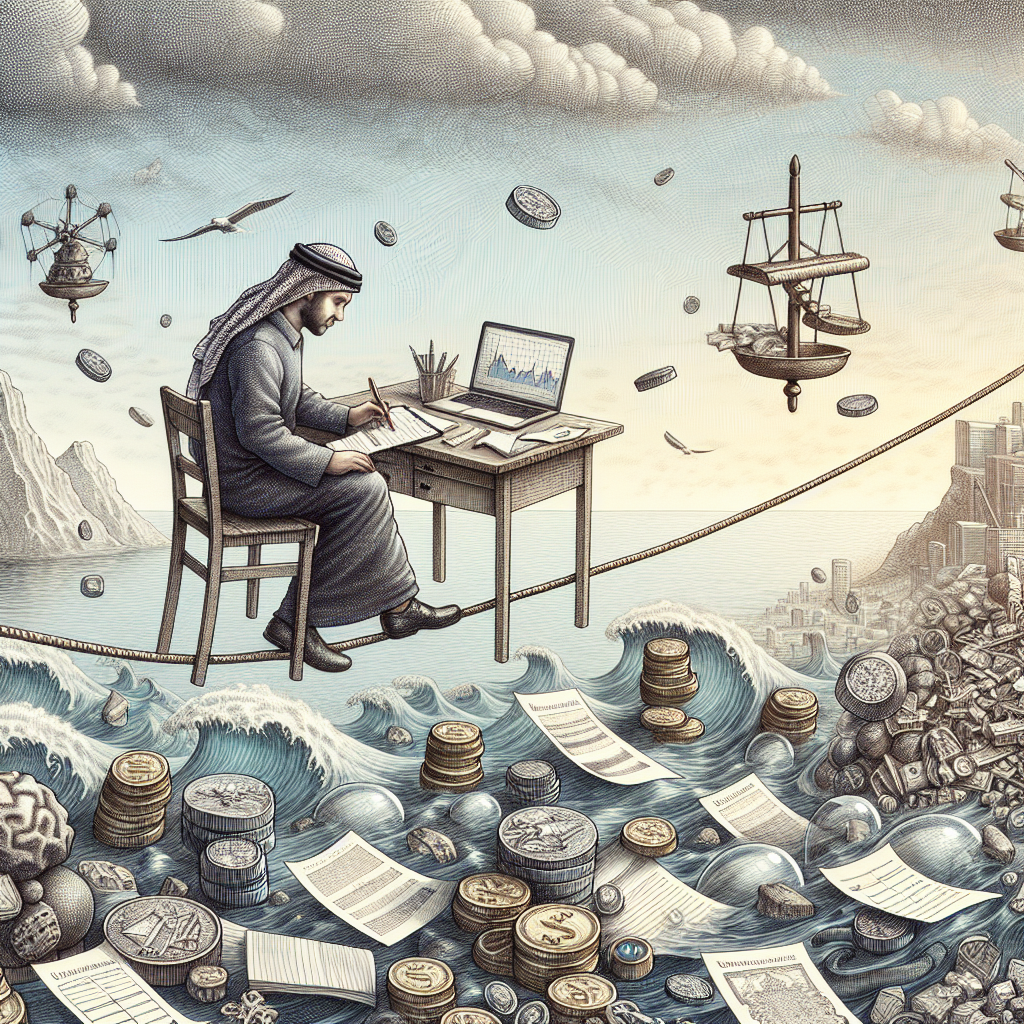

Risk refers to the possibility of losing money or not achieving the expected return on an investment. In the context of wealth creation, it can be considered both a friend and a foe. On the one hand, risk can lead to significant gains; on the other, it can result in substantial losses. The key lies in understanding and managing these risks effectively to harness their potential for wealth creation.

The Different Types of Risks

-

Market Risk: This is the risk associated with changes in market prices and is often caused by economic shifts, news events, or geopolitical tensions. Understanding market risk can help investors anticipate market fluctuations and adjust their strategies accordingly.

-

Credit Risk: This type of risk arises when a borrower fails to repay a loan or meet contractual obligations. Investors engaging in bonds or loans must assess credit risk to mitigate losses.

-

Liquidity Risk: This risk relates to the ease with which an asset can be bought or sold without impacting its price. Investing in illiquid assets can lead to challenges when attempting to cash out.

-

Operational Risk: This involves risks arising from failures in internal processes, systems, or people. Companies must have robust systems in place to minimize these risks.

- Foreign Exchange Risk: Investors in foreign assets are subject to currency fluctuations that can affect returns. Understanding foreign exchange risk is essential for those looking to diversify their portfolios internationally.

The Relationship Between Risk and Return

The relationship between risk and return is a fundamental principle of investing. Generally, the higher the risk an investor is willing to take, the higher the potential return. Conversely, lower-risk investments often yield lower returns. Understanding this relationship is essential for developing a personal investment strategy that aligns with individual financial goals and risk tolerance.

Developing Your Risk Tolerance

Risk tolerance is the degree of variability in investment returns that an individual is willing to withstand. It can be influenced by several factors, including:

- Time Horizon: Longer investment horizons typically allow for more risk since short-term volatility can be smoothed out over time.

- Financial Situation: Individuals with a stable income and substantial savings may feel comfortable taking on more risk compared to those with limited resources.

- Psychological Factors: Personal feelings toward loss and financial security can profoundly impact one’s risk tolerance.

Investors should assess their risk tolerance regularly to ensure their investment strategies remain aligned with personal circumstances and market conditions.

Strategies for Managing Risk

Effectively managing risk is vital for successful wealth creation. Here are several strategies to consider:

-

Diversification: Spreading investments across different asset classes reduces the risk of significant losses. A diversified portfolio can help mitigate the impact of poor performance in any one area.

-

Asset Allocation: Allocating assets based on risk tolerance and investment goals is crucial. A mix of stocks, bonds, and cash can provide a balanced approach that aligns with individual objectives.

-

Regular Rebalancing: Periodically reviewing and adjusting your investment portfolio ensures that it remains aligned with your risk tolerance and market conditions. This practice can help prevent overexposure to any single asset class.

-

Research and Education: Staying informed about market trends, economic indicators, and investment opportunities can significantly enhance decision-making skills and risk management.

- Using Stop-Loss Orders: In volatile markets, stop-loss orders can protect investments by automatically selling assets when they reach a specified price, minimizing potential losses.

The Role of Professional Guidance

Navigating the world of investing can be challenging, especially for novice investors. Seeking guidance from financial advisors or investment professionals can provide valuable insights and tailored strategies for understanding and managing risk.

Conclusion: The Art of Balancing Risk for Wealth Creation

Achieving financial freedom and security requires a delicate balance between risk and return. By understanding different types of risks, developing a clear risk tolerance, and employing effective management strategies, anyone can embark on their wealth creation journey with confidence. In this dynamic landscape, knowledge and proactive planning are your best allies in the endeavor to build and sustain wealth over time.