Wealth management can be a daunting task, especially when trying to ensure stability and growth over time. One of the most fundamental strategies to achieve a robust financial portfolio is diversification. In this article, we will explore what diversification is, why it’s essential, and how you can implement it effectively to safeguard your investments.

What is Diversification?

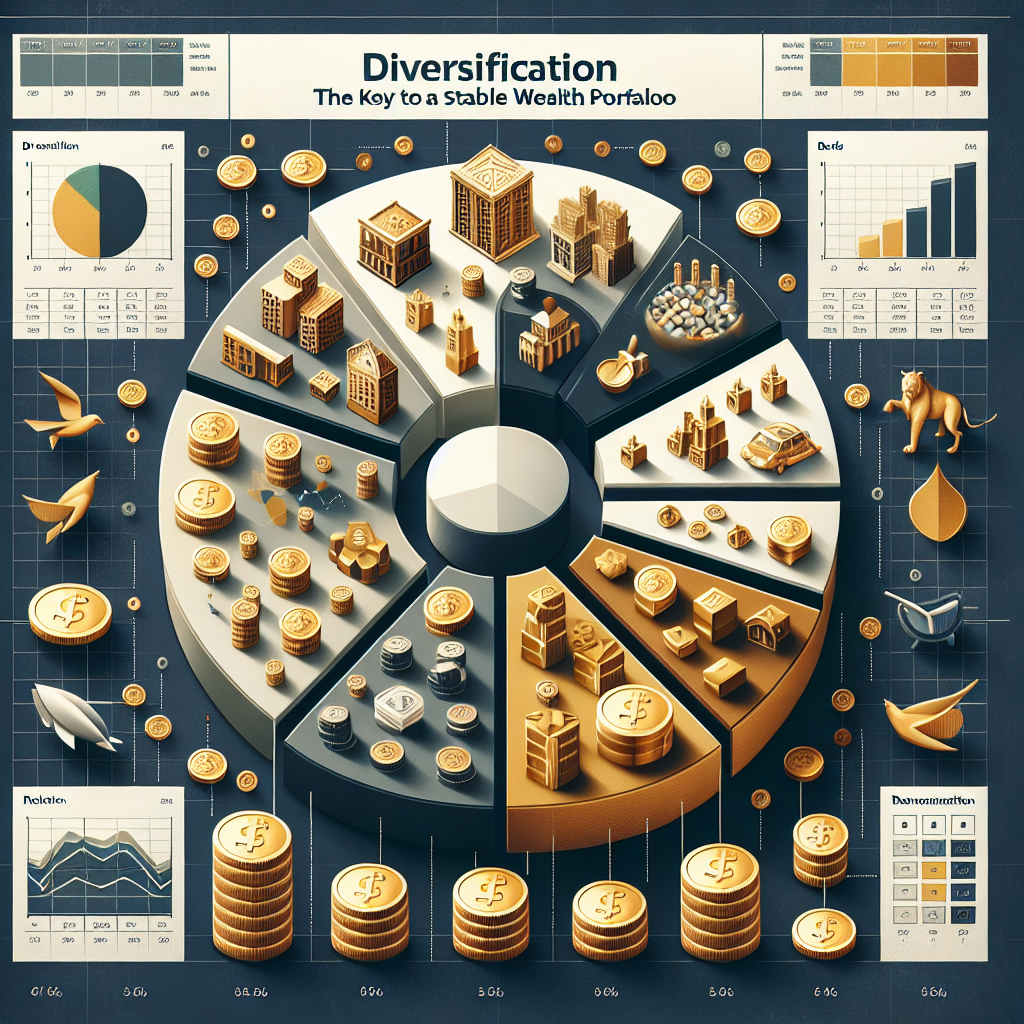

Diversification is an investment strategy that involves spreading your investments across various assets or asset classes. The primary goal is to reduce risk and volatility while improving the potential for returns. Rather than putting all your eggs in one basket, diversification encourages investors to allocate their resources across a spectrum of investments, including stocks, bonds, real estate, and alternative assets.

Why is Diversification Important?

1. Risk Mitigation

Diversification serves as a safety net for investors. By holding a variety of assets, the overall risk is diminished. If one investment underperforms, others may perform well, balancing out the potential losses. This is particularly crucial in volatile markets where individual asset prices can fluctuate widely.

2. Improved Returns

While diversification does not guarantee profits, it can enhance the potential for returns over the long term. Different asset classes often react differently to economic events. For instance, when stock prices dip, bond values may increase, stabilizing your portfolio’s overall value.

3. Adaptability to Market Changes

The financial landscape is constantly evolving, and what works today may not be effective tomorrow. A diversified portfolio is more adaptable to market changes. By including a mix of assets, you can better withstand economic downturns and capitalize on emerging opportunities.

How to Build a Diversified Portfolio

1. Assess Your Risk Tolerance

Before diversifying, it’s essential to understand your risk tolerance. Are you a conservative investor who prefers stability, or are you willing to take on more risk for potentially higher returns? Your risk tolerance will dictate your asset allocation.

2. Choose a Mix of Asset Classes

A well-diversified portfolio should include a range of asset classes:

- Stocks: Equities can offer significant growth potential. Consider a mix of domestic and international stocks across various sectors.

- Bonds: Fixed-income securities provide stability and can hedge against stock market volatility.

- Real Estate: Real estate investments can serve as a good inflation hedge and offer passive income.

- Alternative Investments: Commodities, cryptocurrencies, and private equity can provide further diversification.

3. Diversify Within Asset Classes

Diversification within an asset class is equally important. For example, if you invest in stocks, consider diversifying by market capitalization (large-cap, mid-cap, small-cap) and sectors (technology, healthcare, finance). By doing so, you ensure that your investments are not overly concentrated in any one area.

4. Rebalance Your Portfolio Regularly

Over time, certain investments may outperform others, skewing your asset allocation. Regularly rebalancing your portfolio by selling high-performing assets and buying underperforming ones helps maintain your desired level of diversification.

Common Mistakes in Diversification to Avoid

1. Over-Diversification

While spreading investments is essential, too much diversification can lead to dilution of returns. If you own too many assets, it may be challenging to manage them effectively and track performance.

2. Focusing Solely on Historical Returns

Investors often make the mistake of choosing assets solely based on past performance. Remember, historical returns do not guarantee future success, and it’s essential to consider current market conditions and future growth potential.

3. Ignoring Costs and Fees

Diversifying through multiple investment products can lead to increased costs and fees. Be mindful of these expenses as they can eat into your returns. Aim for low-cost options such as index funds or exchange-traded funds (ETFs) to maintain diversification without sacrificing profits.

Conclusion

Diversification is a critical strategy for anyone looking to build and maintain a stable wealth portfolio. By spreading investments across various asset classes and diversifying within those classes, investors can mitigate risk, enhance potential returns, and adapt to changing market conditions. Remember to regularly assess your risk tolerance, avoid common pitfalls, and rebalance your portfolio to keep it aligned with your financial goals. With careful planning and execution, diversification can become a powerful tool in your wealth management arsenal.