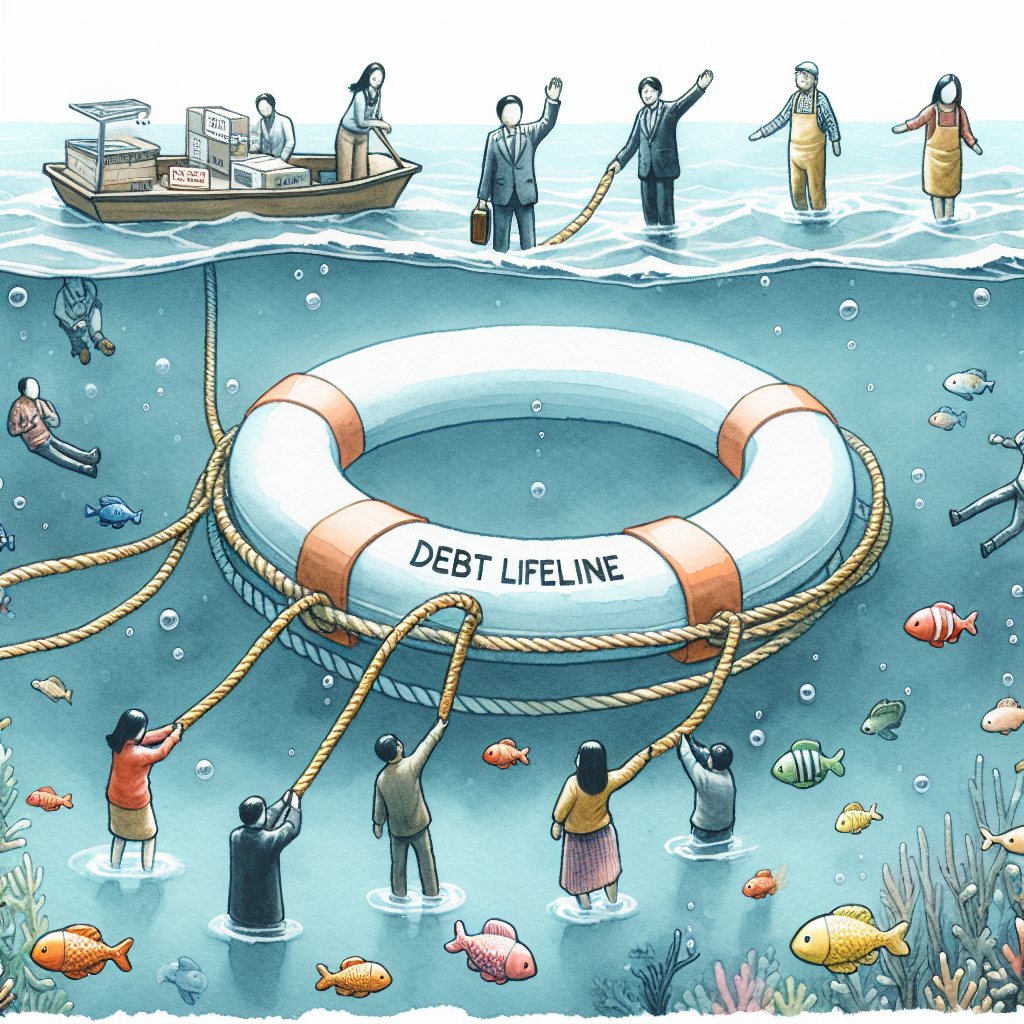

In today’s dynamic economy, small business owners often face financial challenges that can hinder growth and sustainability. One of the most effective strategies to regain financial control is debt consolidation. This article delves into how debt consolidation serves as a lifeline for small business owners, providing clarity on its benefits, the process involved, and tips for successful implementation.

What is Debt Consolidation?

Debt consolidation refers to the process of combining multiple debts into a single loan or payment strategy. For small business owners juggling various financial obligations—such as business loans, credit cards, and unpaid invoices—debt consolidation can simplify their financial management. Instead of making several payments to different creditors, business owners can streamline their payments and potentially secure a lower interest rate.

Why Small Business Owners Utilize Debt Consolidation

1. Simplified Payment Management

Managing multiple debts can be overwhelming, leading to missed payments and increased interest costs. Debt consolidation centralizes payment into one manageable monthly installment, helping small business owners stay organized and on top of their financial obligations.

2. Lower Interest Rates

Many small business owners face high-interest rates on credit cards and loans. By consolidating debts, they can take advantage of lower interest rates offered by consolidation loans, ultimately reducing their total payment amounts and saving money in the long run.

3. Improved Cash Flow

Debt consolidation makes it easier for small business owners to improve their cash flow by decreasing monthly payment amounts. This extra cash can be redirected towards important business operations, growth initiatives, or emergency funds.

4. Enhanced Credit Score

Debt consolidation can contribute to improving a business owner’s credit score by decreasing the credit utilization ratio. By paying off existing debts rather than accumulating more, business owners can demonstrate responsible financial management, which is a positive signal to lenders.

The Debt Consolidation Process for Small Business Owners

1. Assess Financial Situation

Before embarking on the debt consolidation journey, business owners should conduct a thorough assessment of their financial situation. This includes listing all outstanding debts, interest rates, monthly payments, and identifying any potential cash flow issues.

2. Explore Consolidation Options

There are various debt consolidation methods available to small business owners, including:

- Personal Loans: Often used for consolidating debt, personal loans can be ideal for business owners with good credit.

- Business Debt Consolidation Loans: Specifically designed for small business owners, these loans can help consolidate business-related debts.

- Balance Transfer Credit Cards: Business owners can consider transferring high-interest credit card balances to a card with a lower interest rate.

3. Apply for Consolidation

Once the right option has been identified, small business owners can begin the application process. This may involve preparing necessary documentation, including financial statements, business plans, and credit histories.

4. Create a New Repayment Plan

After securing a consolidation loan, it’s crucial to develop a realistic repayment plan. This plan should account for the business’s income and expenses and ensure timely payments to avoid falling back into debt.

Tips for Successful Debt Consolidation

1. Maintain Financial Discipline

The process of debt consolidation requires stringent financial discipline. It’s important for small business owners to avoid accumulating new debt while paying off existing liabilities.

2. Monitor Financial Performance

Regularly monitoring cash flow and financial performance is essential. Using budgeting tools and accounting software can provide insights and help make informed decisions moving forward.

3. Seek Professional Help

Consulting financial advisors or debt counselors can offer valuable guidance throughout the debt consolidation process. These professionals can help identify the most suitable options and provide strategies for maintaining financial health.

Conclusion

Debt consolidation can be a vital lifeline for small business owners facing overwhelming financial challenges. By simplifying payment management, reducing interest rates, and improving cash flow, debt consolidation enables businesses to regain focus and foster growth. With careful planning, disciplined financial management, and strategic decision-making, small business owners can utilize debt consolidation to achieve lasting financial stability and success. Remember, the key to thriving in the competitive business landscape lies in taking proactive steps towards better financial management.