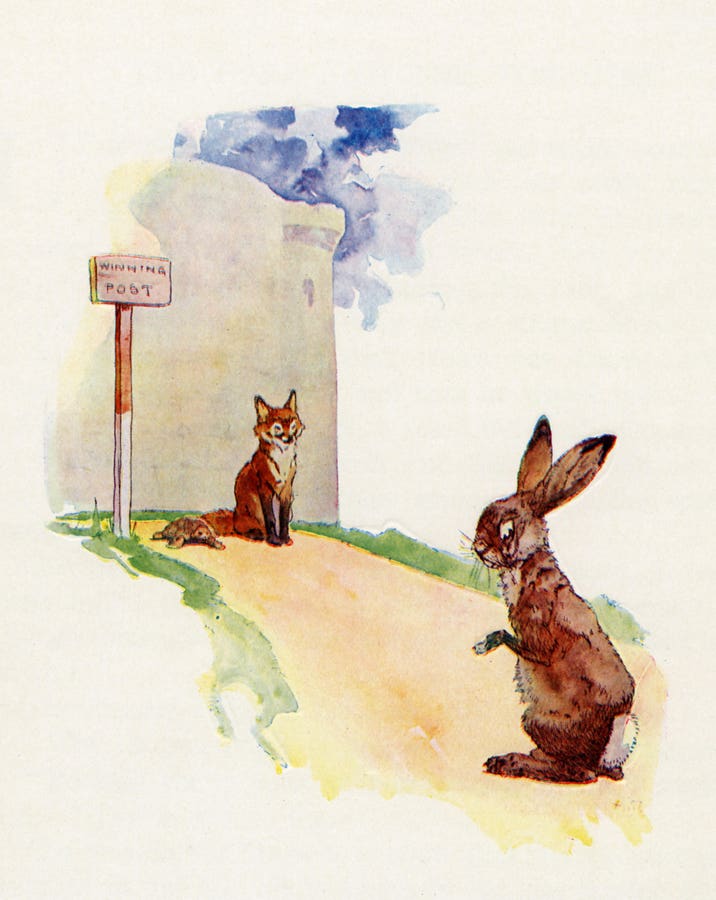

Children’s stories often provide powerful lessons for adult life, and The Tortoise and the Hare is a timeless example. While the story may raise some amusing questions—like whether a rabbit would actually lose to a tortoise, or why anyone calls a rabbit a “hare”—the message behind it can be surprisingly relevant to investing.

So, when thinking about investing, should one be the tortoise or the hare? The answer is both.

Investing: A Marathon and a Sprint

Investing is a mix of long-term patience (the tortoise) and short-term action (the hare). Two fundamental principles make this clear: the power of time and the magic of compounding.

The Tortoise: The Power of Time

The impact of time on investments is significant. The longer money remains invested, the more compounding can work its magic. For example, a 10% return is great, but when compounded over 7.2 years, it results in potentially doubling the original investment. This highlights the importance of starting early and investing consistently. Delaying investments in favor of other financial goals, like becoming debt-free, often results in missed opportunities. The lesson from the tortoise is clear: slow and steady wins by giving investments time to grow.

The Hare: Front-Loading Investments

On the other hand, the hare represents the importance of front-loading investments. The more money invested early on, the more powerful the compounding effect becomes. For instance, investing $1,000 and leaving it to grow at 10% could result in it potentially doubling multiple times over the years, turning it into $16,000. But if that initial investment were $1,000,000, the result would be $16,000,000 by the same point. This demonstrates the hare’s contribution: the larger the upfront investment, the greater the potential for long-term growth.

Combining the Two

Both the tortoise and the hare play essential roles in a successful investment strategy. Giving investments time to grow, while also contributing as much as possible early on, maximizes the benefits of compounding.

For example, waiting to invest because of a bad year in the markets could mean missing out on significant gains. If the market had a 40% rebound, $1,000 invested could grow to $1,400, while $1,000,000 could grow to $1,400,000. The difference is striking and underscores the importance of both time and front-loaded investments.

This approach can shape investment strategies in practical ways. Extra savings sitting idle might be better put to work in the market, or small, consistent investments could be made instead of focusing solely on paying off debts.

The next time someone asks about an investment philosophy, the answer is simple: invest like both the tortoise and the hare.

Read the full article here