In a pivotal decision on Jan. 23, 2025, the Supreme Court granted the government’s motion to stay a nationwide injunction issued by a federal judge in Texas in the case of Texas Top Cop Shop, Inc. v. McHenry. This injunction initially sought to halt the enforcement of beneficial ownership reporting requirements mandated by the Corporate Transparency Act, which is overseen by the Financial Crimes Enforcement Network.

Justice Neil Gorsuch, concurring with the decision to grant the stay, proposed that the Supreme Court should clarify whether district courts have the authority to issue universal injunctive relief. This aligns with Justice Gorsuch’s previous views expressed in Labrador v. Poe and Department of Homeland Security v. New York, where he advocated for a more definitive resolution on the scope of district courts’ powers.

However, not all justices agreed. Justice Ketanji Brown Jackson dissented, arguing that the emergency relief was unwarranted, as the government did not demonstrate sufficient urgency. She noted that the Fifth Circuit had expedited the consideration of the government’s appeal, questioning the necessity of the Supreme Court’s intervention at this stage.

The timeline of the case began with the initial injunction issued by a federal judge in Texas, which aimed to halt the enforcement of the beneficial ownership reporting requirements under the Corporate Transparency Act, as seen in Texas Top Cop Shop, Inc. v. McHenry. Following this, on Jan. 23, 2025, the Supreme Court stayed this injunction, potentially allowing the requirements to be enforced unless further legal decisions intervene.

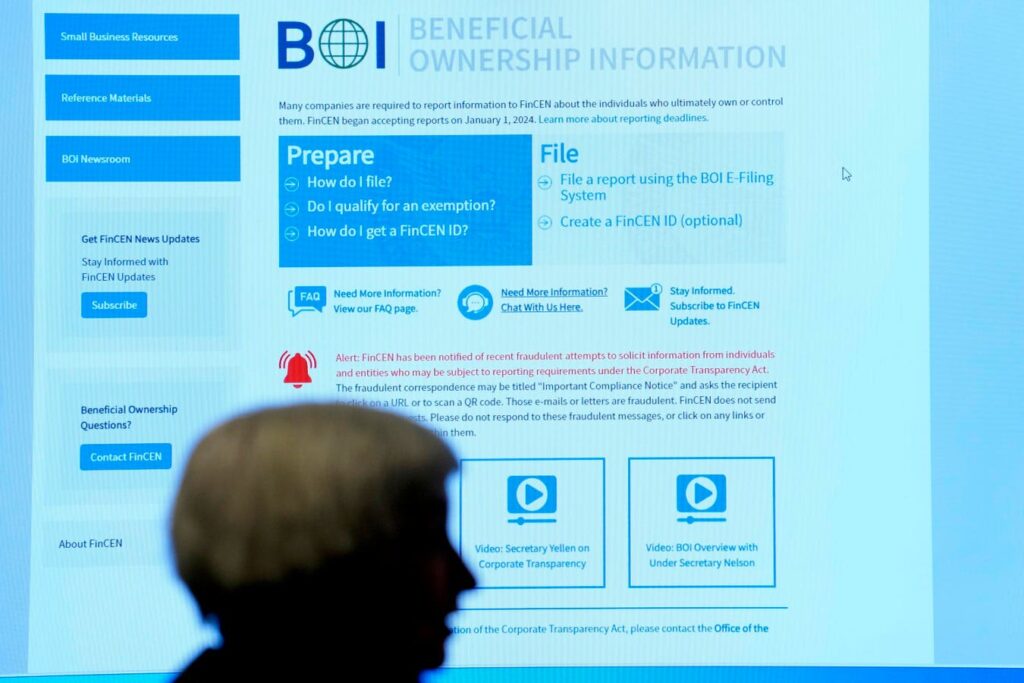

Despite the Supreme Court’s decision in Texas Top Cop Shop, FinCEN’s requirements are currently on hold due to a separate injunction issued by another federal judge in Texas in the case of Smith v. U.S. Department of the Treasury. As a result, reporting companies are not currently obligated to file beneficial ownership information with FinCEN. There are no liabilities for failing to file this information if the Smith order is in effect. However, companies have the option to voluntarily submit beneficial ownership information reports if they choose.

If the Supreme Court ultimately overturns the District Court’s ruling, it will likely reinstate the enforcement of the beneficial ownership reporting requirements, compelling companies to comply promptly. This would mark a significant shift in regulatory enforcement, requiring businesses to gather and submit the necessary information immediately. Conversely, if the Supreme Court upholds the District Court’s ruling, the injunction will remain in effect, continuing the pause on enforcement and allowing companies to delay compliance. This would maintain the current legal landscape, offering businesses a temporary reprieve from these reporting obligations while broader legal issues surrounding district courts’ powers are further clarified.

The ongoing legal proceedings underscore the complex interplay between judicial decisions and regulatory enforcement. For businesses, the current environment offers a temporary reprieve from compliance with beneficial ownership reporting requirements yet suggests potential future changes depending on the outcomes of ongoing appeals and legal challenges.

We recommend that clients either file voluntarily or collect Beneficial Ownership Information and provide it to the Reporting Company, enabling them to file the required information promptly once a final decision is reached.

Read the full article here