Previously, we discussed how, on December 3, 2024, the U.S. District Court for the Eastern District of Texas issued a nationwide preliminary injunction in Texas Top Cop Shop, Inc. v. Garland, halting enforcement of the Corporate Transparency Act (CTA) and its beneficial ownership information (BOI) reporting requirements[1]. The court found that the CTA likely exceeds Congress’s constitutional authority, and that compliance would impose significant burdens on businesses.

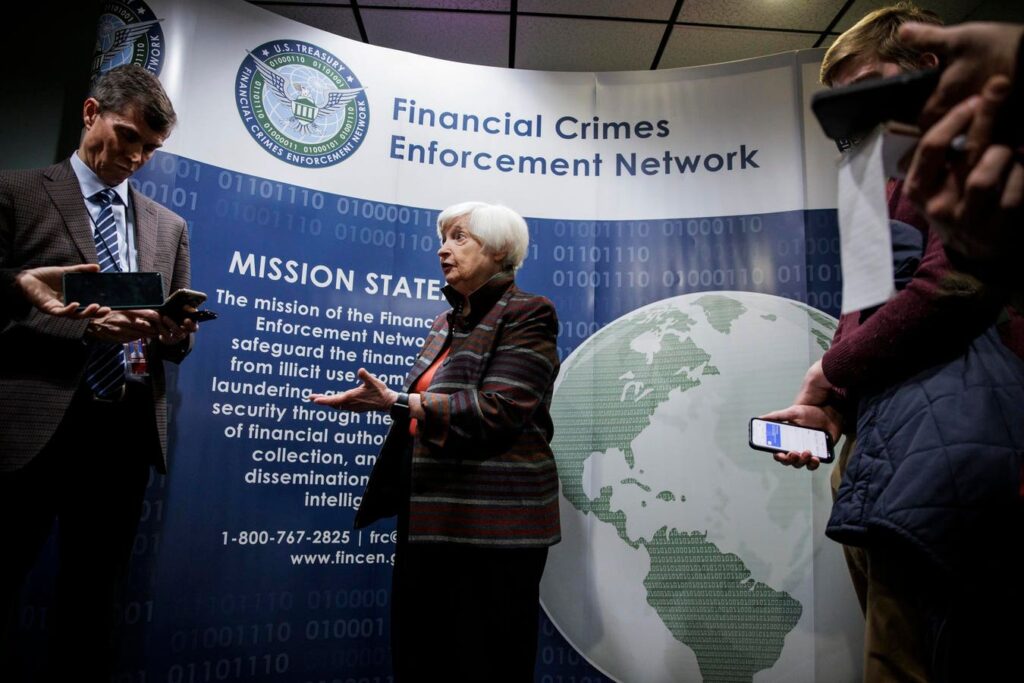

In response, the Department of Justice filed an appeal on December 5, 2024, seeking to overturn the injunction. The appellate court’s decision will determine whether the CTA’s reporting requirements will be reinstated or remain suspended. While the appeal is pending, the Financial Crimes Enforcement Network (FinCEN) has indicated that BOI reports are voluntary, and businesses are not required to comply with the January 1, 2025, reporting deadline so long as the injunction remains in effect.[2]

We recommend that clients stay informed about developments in this case and be prepared to comply with the CTA’s requirements swiftly if the injunction is lifted. Please consult with legal counsel to assess the potential impact on your specific situation.

[1]

[2]

?

Read the full article here