In the evolving landscape of wealth management, family offices are increasingly looking to diversify their portfolios by making direct investments into alternative assets where before they were more likely to invest as a limited partner of a fund. For decades UHNW individuals have been making direct purchases of art and collectibles. Now family offices are increasingly viewing those purchases as an alternative investment to be included in the client’s portfolio and planning. Direct investment in private equity alternative assets require a level of due diligence and strategic planning. If art and collectibles are included in the portfolio of family office clients, can and should UHNW clients and their family offices apply the same or similar discipline they use for private equity direct investments to the unique alternative asset that are artwork and collectibles?

Understanding the Market Potential of Collectibles

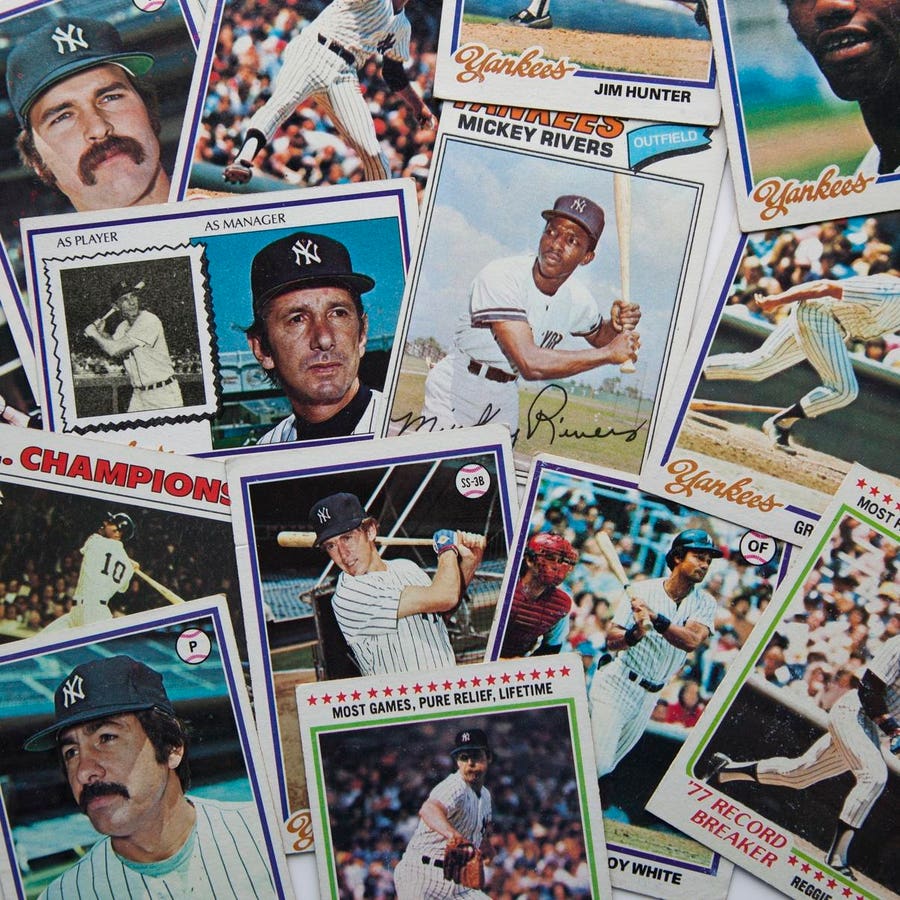

The market for collectibles, including contemporary art, sports memorabilia, luxury watches, and rare coins, is vast and expanding. Estimated at $412 billion in 2020, it is projected to reach $628 billion by 2031. Some collectibles can offer a low correlation with traditional markets, making them attractive to family offices seeking diversification. The collectibles market has its own unique challenges, however.

Challenges in Collectible Investments

Unlike private equity, collectible markets are informal, fragmented, and lightly regulated, lacking standardized deal funnels and data transparency. Family offices often face barriers such as high transaction costs, forgery risks, and a scarcity of expert knowledge, which complicate the investment process. Cultural and emotional factors further influence buying decisions, often prioritizing personal or sentimental value over financial metrics.

Adopting a PE-Inspired Framework

Family offices, and their UHNW clients, might mitigate these challenges by adopting a structured investment approach like PE. Key phases include:

- Discovery: Building networks with auction houses, galleries, and industry experts to source opportunities. Leveraging data platforms and attending trade shows can enhance deal flow.

- Due Diligence: Implementing rigorous authentication, valuation, and risk analysis. This includes verifying the authenticity and provenance of items, assessing their condition, and understanding market and legal nuances.

- Delivery: Focusing on portfolio integration, risk management, and exit planning. This involves cataloging assets, securing proper storage, and planning strategic exits through auctions or private sales.

Strategizing for Success

Family offices should build structured processes, leverage technology, and engage experts to professionalize collectible investments. Formalizing portfolio management and educating staff can enhance decision-making and governance. Collaborating with financial institutions for advisory services and scenario planning for illiquidity are also recommended strategies.

There will be, however, a gap between emotional attachment to collectibles and financial discipline. If family offices can transform collectibles into strategic assets, they will have to achieve both enrichment and financial returns to the client and their family. As the market evolves, combining passion with a methodical approach can lead to significant gains in this dynamic investment landscape. Ignoring the client’s investment in artwork and collectibles runs a serious risk to the family office.

Read the full article here