Late last year, the Internal Revenue Service announced a phased rollout of reporting requirements for businesses that receive at least some of their income through third-party payment apps. If you are a small business owner who receives money for goods and/or services through Venmo, PayPal, eBay, Etsy, or other third-party apps, you may be receiving a 1099-K form from them and there are some things you should know.

When Is A 1099 Form Used?

The IRS uses 1099 forms for reporting income earned outside of a traditional employer. Generally, the most common type of form used by self-employed individuals and other small business owners is the 1099-NEC (nonemployee compensation), which covers payments for work as an individual contractor. However, there are 21 other types of 1099 forms.

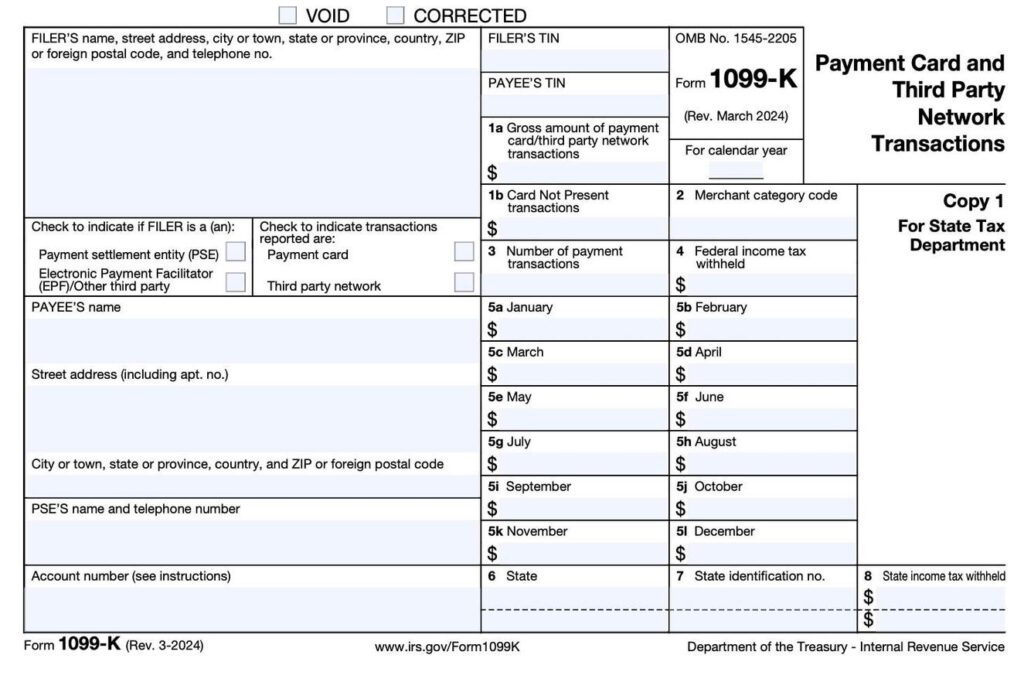

1099-K forms are also for nonemployee compensation, but differ in that they cover payments received through third-party payment apps instead of directly from the business (Note: This does not apply to payments from family or friends). In November, the IRS announced a three-year plan for lowering the reporting threshold for 1099-Ks with the ultimate goal being more than $600 in gross income for a year. For 2024, third-party apps will be required to issue 1099-K forms to individuals whose total payments for transactions were more than $5,000. That number will drop to over $2,500 in 2025, before settling at more than $600 in 2026 and moving forward.

Requirements For 1099-K Changed Under President Joe Biden

A provision in the American Rescue Plan Act lowered the 1099-K reporting requirement and it’s highly likely that the new Congress will look to raise it back to the previous threshold of $20,000 and 200 transactions in a future legislative package. In September last year, the House of Representatives Ways and Means Committee marked up legislation doing just that. With Representative Jason Smith (MO-08) returning as committee chairman and Republicans controlling both chambers, this issue is far from settled.

In the meantime, if you are a business owner who made more than $5,000 in 2024 through one third-party app, that company will be sending you and the IRS a 1099-K form. In addition, some states have lower thresholds. Vermont, Massachusetts, Virginia, and Maryland have set their bar at $600 and Illinois’ is more than $1,000 over four or more separate transactions. Fortunately, third-party apps including eBay, Venmo, Etsy, PayPal, and Cash, all have resource centers with information on this process.

If you meet these requirements, you likely have already received your 1099-K or will very soon. The IRS also offers a resource center for better understanding all aspects of the 1099-K, and if you need additional guidance, it may be worth checking in with an accountant. With the tax filing deadline less than three months away, it is better to be safe than sorry.

Read the full article here