On Feb. 6, 2025, President Donald Trump met with congressional Republicans to set the stage for what could be one of the most significant tax overhauls in recent history. House hearings will commence this week, with Speaker Mike Johnson (R-La.) signaling that legislation could pass the House of Representatives by April. Republicans are aiming for “one big, beautiful bill,” but the path forward is unclear.

The contours of the proposed legislation are still taking shape, but Trump and GOP leaders are intent on passing a sweeping tax package in 2025. Divisions within the Republican caucus hint at a contentious legislative process.

Key Provisions Of President Trump’s Proposed Tax Plan

Trump’s aggressive tax agenda includes the following measures:

- Extension of the Tax Cuts and Jobs Act through Dec. 31, 2034.

- Elimination of income taxes on overtime pay.

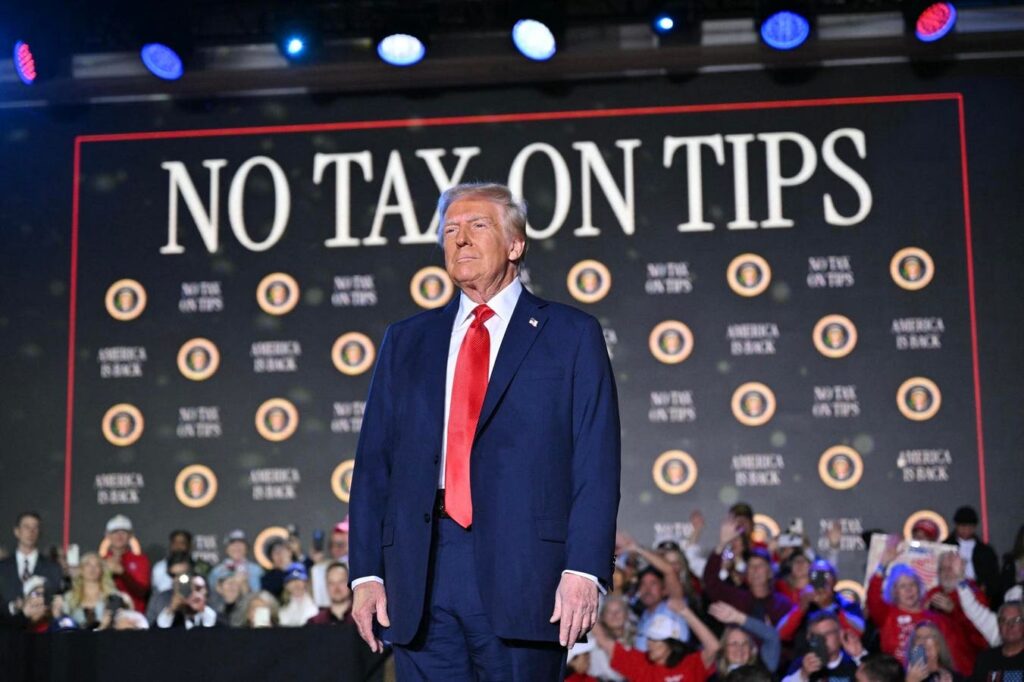

- Elimination of income taxes on tips.

- Removal of income taxes on Social Security income.

- Reduction of corporate income taxes for companies that manufacture goods domestically.

- Increase in the State and Local Tax deduction, which was previously capped at $10,000 per family under the TCJA.

The Costs And Fiscal Impact

While the specifics have not been released, preliminary estimates suggest the cost of this tax package could range from $5 trillion to $11 trillion, depending on the final provisions. A middle-ground projection pegs the cost at around $8 trillion through 2034, factoring in lost revenue and increased interest on the national debt.

Adding to the fiscal complexity, Senate Republicans recently introduced a bill to boost spending on border security and defense — key elements of Trump’s agenda. This could add another $340 billion to the overall cost, pushing the total package to approximately $8.34 trillion.

How Will It Be Funded?

Republicans are united on which tax cuts they want to pursue but remain divided on how to offset the costs. Current proposals include $1 trillion to $2.5 trillion in spending cuts and the rollback of $250 billion in green energy subsidies. However, this would still leave a gap of $6.5 trillion.

Some GOP leaders argue that extending the TCJA and cutting taxes further will spur economic growth, potentially generating an additional $3 trillion in tax revenue over the next decade. Yet, historical data from major tax cuts in 1981, 2001, and 2017 suggest that economic growth in the five years following each of those tax cuts was similar to the growth in the preceding five years. Economists remain divided on the effectiveness of tax cuts as a growth catalyst. There are many factors affecting economic growth including: global economic conditions, geopolitical conflicts, labor productivity, demographic shifts, the regulatory environment, etc.

Even under optimistic growth scenarios, the proposed tax plan would add at least $3.5 trillion to the national debt. With the U.S. national debt already exceeding $36 trillion and an annual structural federal deficit approaching $2 trillion, these numbers are raising red flags among fiscal conservatives.

What’s Next?

Trump is determined to push this legislation through Congress, leveraging his influence over Republican lawmakers, particularly those facing re-election. The Republicans have historically narrow majorities in Congress.

The Congressional Budget Office is expected to score the legislation as significantly increasing the national debt, a factor that could sway fiscally conservative Republicans and fuel debate.

As this legislative drama unfolds, all eyes will be on Capitol Hill. The coming months promise heated debates, political maneuvering, and high-stakes negotiations. Whether Trump’s ambitious tax overhaul becomes law remains to be seen, but one thing is certain — the road ahead will be anything but smooth.

Read the full article here