So far in 2025, we’ve had three decisions focused on Code Section 183 , commonly known as the hobby loss rule, although the pedantic will point out that it actually concerns “activities not entered into for profit” be they hobby-like or not. Not surprisingly two of them are about horse breeding. We will take them in order, which let’s us start off with a taxpayer win. There is also a well covered collection case that has a hobby loss angle that I don’t see anybody else mentioning.

Prospect Of Appreciation

Fredenberg v Comm. 2025 TCS 1 (the first summary opinion of the year) was not a total taxpayer win. Roger and Kimberly Fredenberg admitted that there were issues with their 2017 return due to a preparer that didn’t know what she was doing. They had an amended return prepared which was never processed. Judge Carluzzo took the unprocessed amended return into account in sorting through everything.

The Fredenbergs owned a single family house that had been converted into two apartments. Expenses tended to run ahead of rental revenue, which is what got the IRS thinking about Section 183. There was also questions about unreimbursed employee business expenses. (Remember the return is from the olden days before 2018 when the Tax Cuts And Jobs Act went into effect temporarily eliminating miscellaneous itemized deductions.) Judge Carluzzo made quick work of the 183 issue.

“Considering reasonable expectations that the property would appreciate after being repaired and/or renovated, we find that for both years petitioners had the requisite profit motive for otherwise allowable and substantiated deductions even if the total of the deductions exceeds the rental income from the property…”

There were still problems with substantiation. Judge Carluzzo found enough problems in the mileage logs to rate them unreliable which entirely threw out the auto expenses for both the rental property and the employee business expenses. Although there was some weakness in the substantiation of tools and uniforms, the judge found the amount reasonable enough to allow under the Cohan rule.

Rather shockingly nothing was allowed for depreciation. I thought the Cohan rule should have helped there, but no such luck.

Regardless, even though summary opinions are not precedent in court, I would lean on this if a revenue agent tried to bring up Section 183 on a rental property.

The Glue Factory

Our next development, like over 20% of the over 700 Section 183 opinions, I have analyzed is a horse case. It is an appeal to the Second Circuit of a Tax Court opinion in the case of Joseph G. Bucci. Mr. Bucci, whose fortune comes from a rock salt business that keeps many of the streets of the state of New York passable in the winter, dreams of having one of his horses run in the Kentucky Derby. I have to sympathize. “Run For The Roses” is one of my favorite songs.

I covered the opinion in 2023 focusing on Judge Mark Holmes’s odd comment that putting retried thoroughbreds out to pasture rather than sending them to slaughter indicated a lack of a profit motive.

The appeal went nowhere with the Second Circuit finding no overall problem with Judge Holmes’s determination. There seem to be two lessons to be drawn from it. One is that if you are arguing a substantial deficiency in Tax Court, don’t dawdle about engaging an attorney.

The other is to be careful about following the common “same as last year” theory practice of tax return preparation. In disputing the penalty Bucci’s attorneys argued that he had relied on the CPA who prepared the return. The CPA testified that he did not know who had made the decision to report the horse racing activity on Schedule Cs because “those were reported that way before [he] started at his accounting firm”. If there is a Schedule C running large losses every year, you need to think about and document the Section 183 issue every year not rely on a judgement made far in the past.

More Horses

Mark and Deborah Himmel were facing substantial deficiencies Six returns (2004-2009) had total deficiencies of $101,447. The IRS had conceded on accuracy penalties, but there were late file penalties on all the returns. The case has some interesting procedural issues that I have not been able to get into. There were multiple extensions of the statute of limitations making the deficiencies a bit old when IRS issued the notice of deficiency in 2012. The trial was held in 2016 which is not unreasonable, but I can’t figure what it was that took another nine years after that to get the final result. I asked Lew Taishoff, who blogs the Tax Court with great intensity and also covered the opinion. He could not discern what caused the case to kick around for so long.

Judge Ashford did a thorough march through the standard regulatory factors. For those of you who have not memorized them, the 1.183-2(b) factors are:

(1) the manner in which the taxpayer carried on the activity, (2) the expertise of the taxpayer or his or her advisers, (3) the time and effort spent by the taxpayer in carrying on the activity, (4) the expectation that the assets used in the activity may appreciate in value, (5) the success of the taxpayer in carrying on other similar or dissimilar activities, (6) the taxpayer’s history of income or loss with respect to the activity, (7) the amount of occasional profits earned, if any, (8) the financial status of the taxpayer, and (9) whether elements of personal pleasure or recreation were involved.

Although the regulation explicitly states that no one factor is determinative, the case law tells a somewhat different story. Of 276 opinions in which there was a ruling on the first factor, there were only five where that did not align with the outcome. So if you are found to behave in a business-like manner you are going to win and if you don’t you are going to lose almost 98% of the time.

Judge Ashford gives an unusually thorough rundown of the first factor breaking it down into five sub-factors – books and records, business plan, comparable activities, changing operating procedures and advertising. On the books and records the judge was critical that some expenses were paid out of personal accounts and not recorded until year end reconciliation. Further there was no indication that direct and indirect expenses were tracked for each horse. On the comparable activities, there was little in the way of either selling horses or otherwise disposing of them. There were shortcomings on the other sub-factors leading to the overall conclusion that they were not carrying on in a businesslike manner.

Judge Ashford went with the Himmels on factor three (time and effort) and declared that factor two (expertise of advisers) was neutral, giving the remaining factors to the IRS. Overall, there is nothing new here, but that is not going to stop me from covering it.

Aftermath Of A Hobby Loss Case

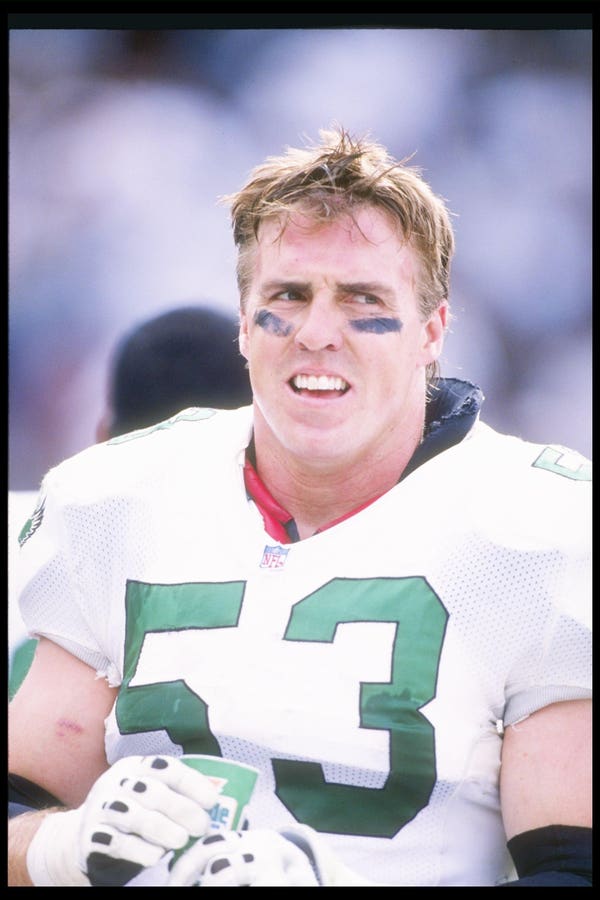

Tax Court possibly followed by an appeal to a higher court is pretty much the end of the line when it comes to the correctness of a tax assessment. Actually collecting the assessment can involve a lot more process. A recent decision in the United States District Court Northern District of California has garnered a good bit of coverage because it involves Bill Romanowski, a somewhat controversial, retired NFL player. The judgement prompted a bankruptcy filing. The judgement was for $15,526.029.76 which includes interest through January 15, 2024. The tax years involved in the underlying deficiency were 1998-2004 and 2007. What is of interest to me is that the bulk of the judgement, the part for the years 1998-2004 totaling $4,752,376 before interest related to a horse breeding Section 183 Tax Court decision that I covered in 2013.

It was not a typical horse case. Romanowski participated in a program which was run by a company called ClassicStar which was purportedly base on mare leasing. The overall program did not end well. I thought it rather odd to design a tax shelter based on horse breeding, given the amount of scrutiny that that industry gets from the IRS.

Read the full article here