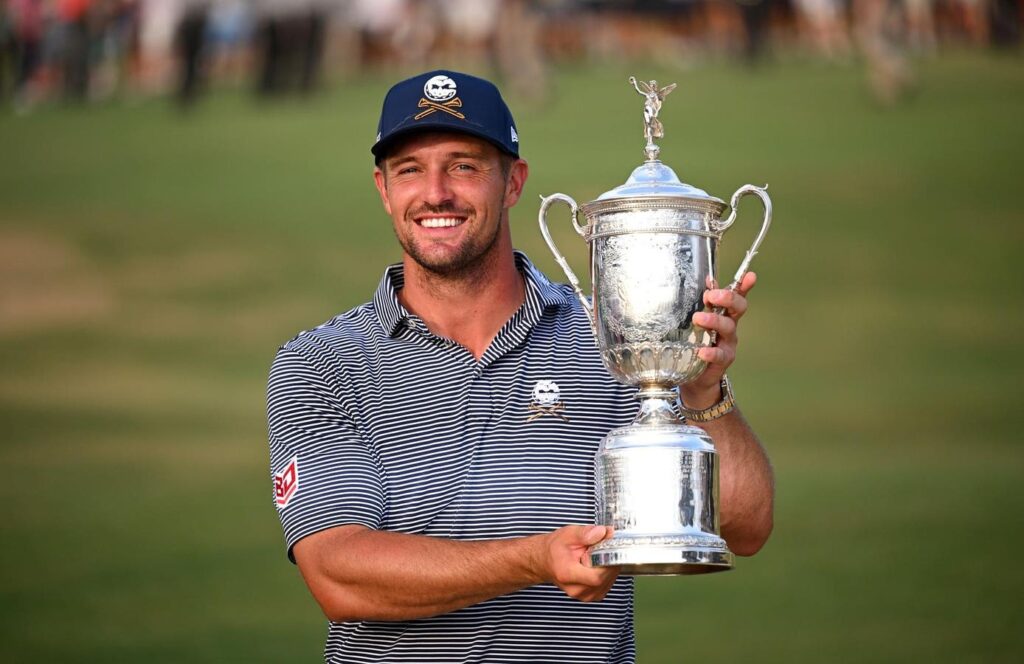

Last year’s U.S. Open Champion, Bryson Dechambeau, had many reasons to smile. In addition to lifting the trophy, he also took home $4.3 million. The U.S. Open continues to represent one of golf’s biggest prizes. While any golfer would give whatever it takes to take home this year’s trophy (first place prize again expected to be $4.3 million), there is an extra layer of incentive this year that makes it even more beneficial relative to future years: taxes. Like Dechambeau’s win last year in North Carolina, this year’s winner can also expect to face relatively low state income taxes levied on their prize in comparison to upcoming years. In this article, I discuss the tax implications of winning at Oakmont and why it differs so much for the next three U.S. Open golf tournaments.

Taxation Of Professional Athletes

Like other professions, when athletes earn money, they are subject to income taxes under Section 61 of the Internal Revenue Code. At the federal level, this rate maxes out at 37% for income over $626,350 ($751,600), meaning that most major professional athletes pay 37 cents for every incremental dollar earned. This tax applies to the athlete’s money from contracts, endorsements, and winnings, among other sources. Furthermore, by being in the top tax bracket, the athlete’s long-term investments will be subject to a higher (albeit preferential) tax rate of 20%.

However, an extra layer of taxation that is less considered by many is state income taxes. Often referred to as the jock tax, athletes must pay state and local income taxes in the jurisdictions where they earn the money. According to Kiplinger, the jock tax has had made news in the past, starting with Michael Jordan being subject to it during the 1991 NBA Finals, subsequently leading to Illinois issuing tax bills to the L.A. Lakers players for the games they played in Chicago. The article also estimates that high-earning basketball players like Nikola Jokic and Steph Curry pay over a million per year for the jock tax due to taxable income earned in other states.

Importantly, the jock tax primarily relates to income earned while physically in that jurisdiction, meaning that athletes’ endorsement income is not subject to other state and local income taxes. This notion leads many professional athletes to live in states that do not levy an income tax. Professional golfers have also taken notice. GolfDigest reports an unusually high concentration of PGA golfers who reside in Florida, Texas, and Nevada to take advantage of the no-state income tax. This means that if the golfer wins a tournament in another state, they will need to pay that state’s income tax on those winnings, but the golfer would not be subject to any additional layers of taxation since their home state does not require the golfer to pay income taxes.

The Tax Advantage Of Oakmont Country Club

Oakmont Country Club is nestled in the suburbs of Pittsburgh, Pennsylvania. As discussed by Forbes, it is widely considered to be among golf’s greatest challenges, and it has hosted the U.S. Open a record 10 times. It is also scheduled to host the U.S. Open again in 2033 and 2042. While the USGA almost certainly selected Oakmont to host this year’s U.S. Open based on it being the golf standard for championship golf, Oakmont also has a significant financial advantage for golfers relative to the upcoming sites.

Pennsylvania boasts one of the lowest state income tax rates levied on income in the entire country, with a 2025 rate of 3.07%. This means that absent any other deductions, the winner of the $4.3 million prize will only pay approximately $132,010 in state income taxes on the winnings.

In contrast, the three upcoming U.S. Open sites are Shinnecock Hills Golf Club (New York), Pebble Beach Golf Links (California), and Winged Foot Golf Club (New York). New York’s top state income tax rate is 10.9%, whereas California’s is 13.3%. This means that the $4.3 million champions prize winner will pay $468,700 (New York) and $571,900 (California) in the upcoming years. As reported by Golf.com, each state also has different withholding tax rules that the golfer needs to adhere to, and this rate can differ by state and by country.

Importantly, when considering the total prize pool of $21.5 million, the collective group of golfers will pay millions more in taxes when the tournament is played in New York and California, relative to recent U.S. Open tournaments in Pennsylvania and North Carolina. The tax liability would be even less if the U.S. Open would be held at a golf course in a no-state income tax rate state like Florida, Texas, Nevada, Tennessee, or Washington, begging the question of whether the USGA and PGA should attempt to locate more of the significant golf tournaments in those states to better the golfers’ wallets.

Despite these challenges, it is important to point out that winning the U.S. Open has countless benefits associated with it and is clearly worth the additional tax headache, regardless of where the tournament takes place that year. Also, H&R Block highlights the numerous tax deductions that are afforded to professional golfers to help lower those tax burdens. Professional golfers should become well versed in the taxes they might owe as well as the ways they can minimize those tax liabilities.

Read the full article here