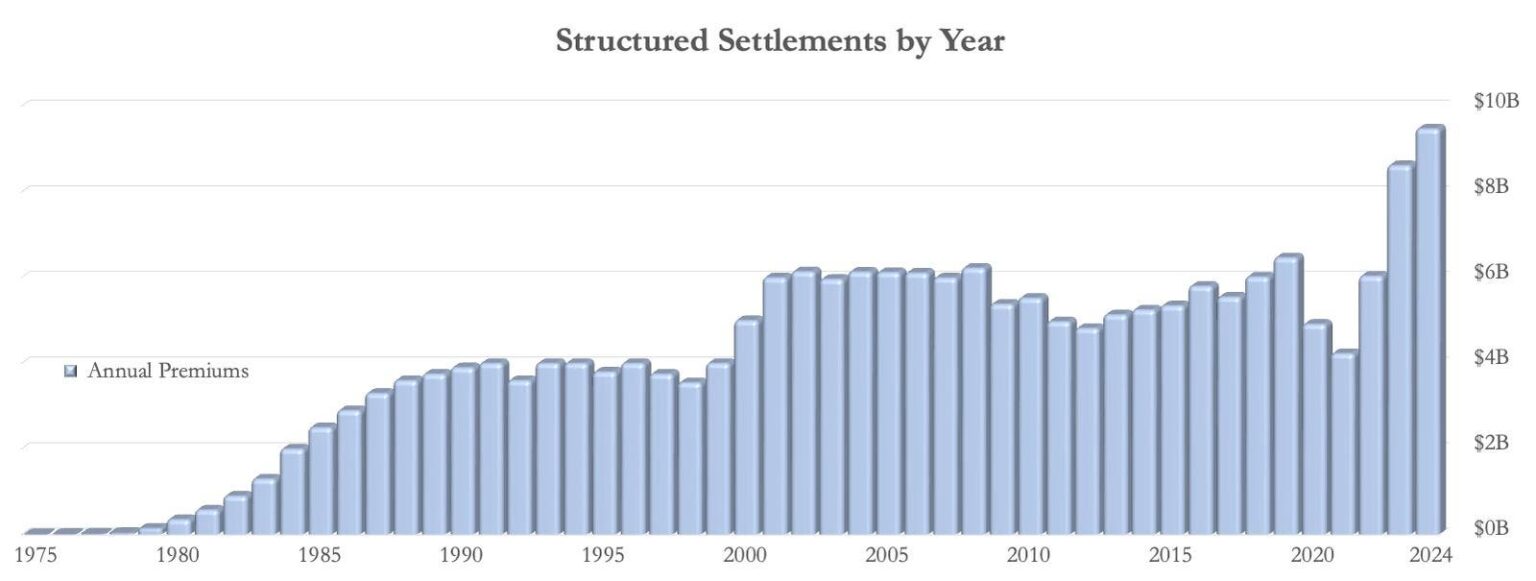

Structured settlements (also known simply as “structures”) are becoming more and more popular. An ever-increasing number of plaintiffs, especially in personal injury lawsuits, opt for scheduled payments in addition to any lump sum received at settlement.

Statistics from the National Structured Settlement Trade Association (NSSTA) bear this out. According to NSSTA, 2024 was a record year, with $9.48 billion of settlement proceeds structured. This is a 10% increase from $8.6 billion in 2023, and a remarkable 58% increase from $6 billion in structured settlements in 2022.

A structured settlement primer

Structured settlements are growing because they provide plaintiffs long-term financial security while also producing favorable tax benefits, allowing plaintiffs to keep more of the money they receive from their settlement. Says NSSTA President Kerri Poe, “I’ve seen firsthand how guaranteed periodic payments empower plaintiffs with peace of mind after settlement.”

When a lawsuit’s settlement calls for one party to pay the other, the defendant (or their insurer) usually pays the plaintiff a lump sum in cash. Unfortunately, most plaintiffs have never before, and will never again, receive such a large one-time payment. Managing such funds to last as long as needed can be difficult. In addition, any investment returns on a lump sum settlement are taxable. As a result, a sum that could be life-changing could also be dissipated far too early.

Enter structured settlements. Instead of a defendant paying a lump sum to a plaintiff, the defendant instead makes a single payment to an “Assignment Company,” which then buys an income-producing investment, sometimes a fixed or life-contingent annuity. The Assignment Company then makes scheduled payments to the plaintiff over a period of years.

This “structure” offers several benefits to plaintiffs. First, it frees them of the burden of researching and executing prudent investment strategies. Instead, they work alongside trained settlement planners before settlement to determine the way to maximize value and safety.

Second, the ongoing nature of structured settlement payments prevents plaintiffs from easily and quickly exhausting what may be an asset they can draw on for the rest of their lives to assist with their long-term care and economic needs.

Third, plaintiffs can customize their income streams, scheduling larger payments to arrive with anticipated expenses. For example, when a child will begin college, they can receive more to help with tuition.

Finally, plaintiffs can enjoy significant tax advantages by choosing structured settlements over lump sum payments. Depending on the plaintiff’s specific situation, tax-free settlement proceeds can be structured in ways that provide them tax-free returns. And taxable settlement proceeds can be structured so the plaintiff can receive tax-deferral benefits (similar to pre-tax contributions to a 401(k)).

“A growing understanding and awareness of the many benefits that Structured Settlements provide, as well as higher interest rates, have driven industry growth over the past several years,” says New York Life’s Structured Settlements Director Matt Benemerito. “As more people understand these benefits, we have a greater opportunity to offer financial security to individuals facing challenging times.”

Increasing in popularity

Unsurprisingly, structured settlements have become well-known and a regular solution used at settlement. In MetLife’s two recent surveys concerning structured settlements, 76% of claims professionals said they would use a structured settlement if they settled a case as a personal injury plaintiff. 96% of employment lawyers said they at least occasionally recommend their clients consider using structured settlements.

Statistics from the National Structured Settlement Trade Association also show that structured settlements are being used in ever-larger cases. In 2022, the average case size was $282,925, up 30 percent from 2021 ($216,963) and up 47 percent from 2012 ($192,472). This shows plaintiffs with higher settlement amounts, and their attorneys, are realizing how much they stand to gain from choosing to structure their settlements.

“Trial lawyers have long used structured settlements to increase the value of what they negotiate,” says Joe Tombs, President of the Society of Settlement Planners and Founder of plaintiff-focused accounting firm Amicus Tax Accountants.

Structured settlements in 2025 and beyond

Based on the record amount of structured settlement premiums in 2024, it’s a safe bet to expect the amount of structured settlement premiums in 2025 will set another record.

Plus, as more attorneys assist their clients with choosing structured settlements and more plaintiffs are happy with their choice, you can expect attorneys to share their experiences with their fellow attorneys and future clients, which will further increase the number of plaintiffs opting for structured settlements for years to come.

At the same time, old and new settlement arrangements are being used more frequently to address problematic tax, benefits, and other rules. These include various types of trusts, settlement funds, and charities.

Read the full article here