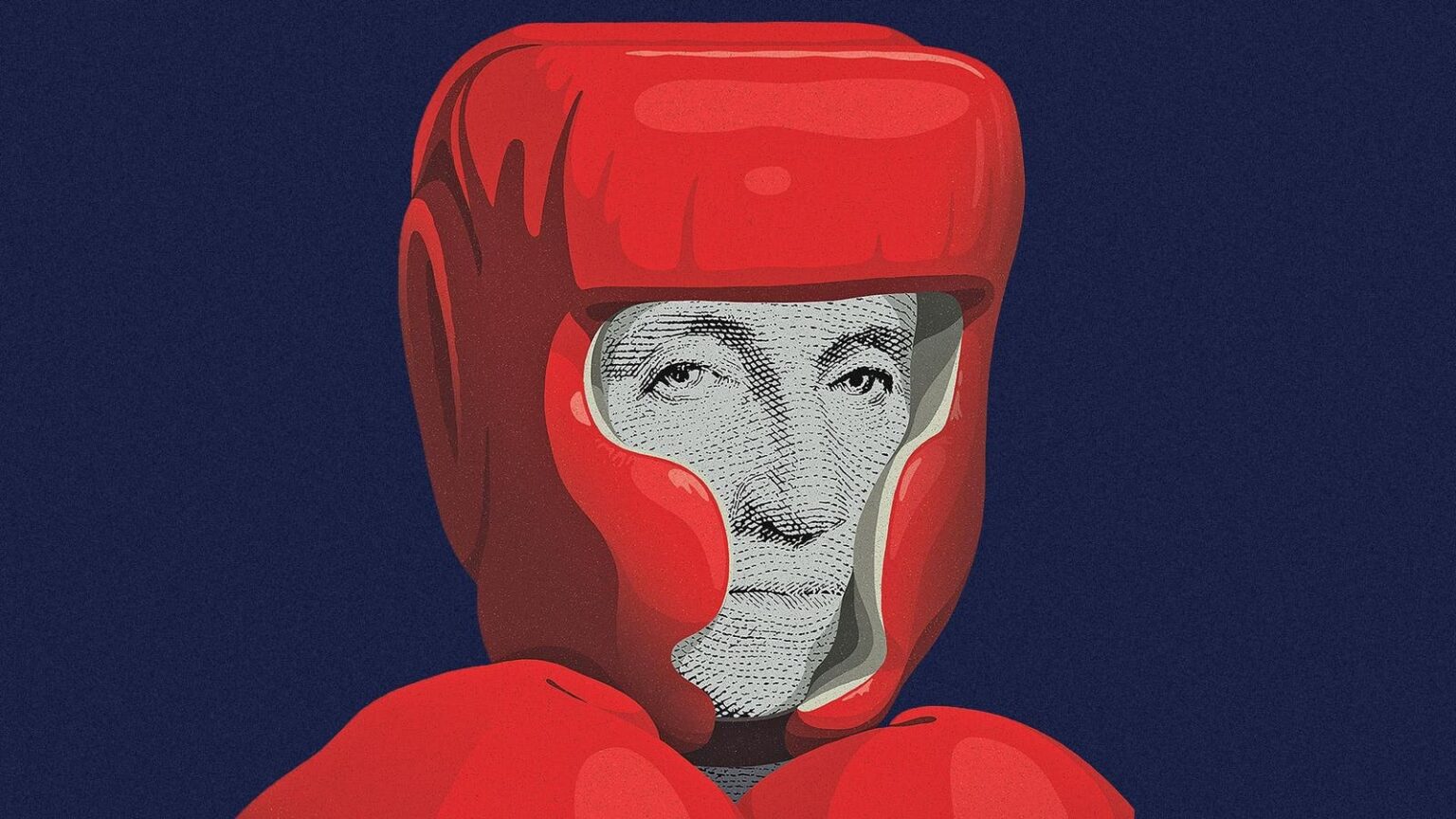

The so-called Trump trade capped two years of gains for investors. Now it’s time to buckle up and protect the wealth you have.

Edited by Janet Novack and Matt Schifrin, Forbes Staff

The last two years of the Biden Administration have been blissful for stock investors. The S&P 500 has gained 60% and the tech stock–heavy Nasdaq 100 has nearly doubled. Bitcoin is up fourfold. But history teaches us that bull markets don’t last forever, and when they fall it can be ruinous to nest eggs and 401(k)s. There are plenty of potential dangers, from interminable wars to intractable budget deficits. And stocks may already be overpriced: The S&P 500’s PE ratio is currently more than double the historical median.

Inflation concerns and a sense of economic vulnerability were largely responsible for Donald Trump’s election, with voters seeming to believe that he would be better for their wallets than Kamala Harris. But the president-elect’s campaign promises—including tax cuts and tariffs on trade that would, per a budget watchdog, add $7.8 trillion to the national debt over 10 years—might well have the opposite effect. The tariffs alone (60% on China; 10% on other countries) would almost certainly hinder growth and spark inflation.

So it might be time to buckle up and hang on to the gains you have. Our post-election investment guide offers smart advice for fixed-income investors who worry about inflation and clever options strategies for those lucky enough to have owned stocks like Nvidia. And for those who want to preserve their wealth across generations, we have a story on family offices, which are now no longer the exclusive preserve of the superrich.

POST-ELECTION INVESTMENT GUIDE

A Family Affair

These days, you don’t need to be a Rockefeller or a Musk to get white-glove wealth services from a private financial office.

READ ARTICLE

How to Stop Worrying and Love Bonds

Donald Trump’s proposals would run up the deficit. What will that do to your bonds? John Cochrane’s fiscal theory points to an answer.

READ ARTICLE

Easy Options

Markets are on fire, but if you’re nervous about scorching returns slipping away, here’s how to protect your big gains.

READ ARTICLE

MORE FROM FORBES

Read the full article here