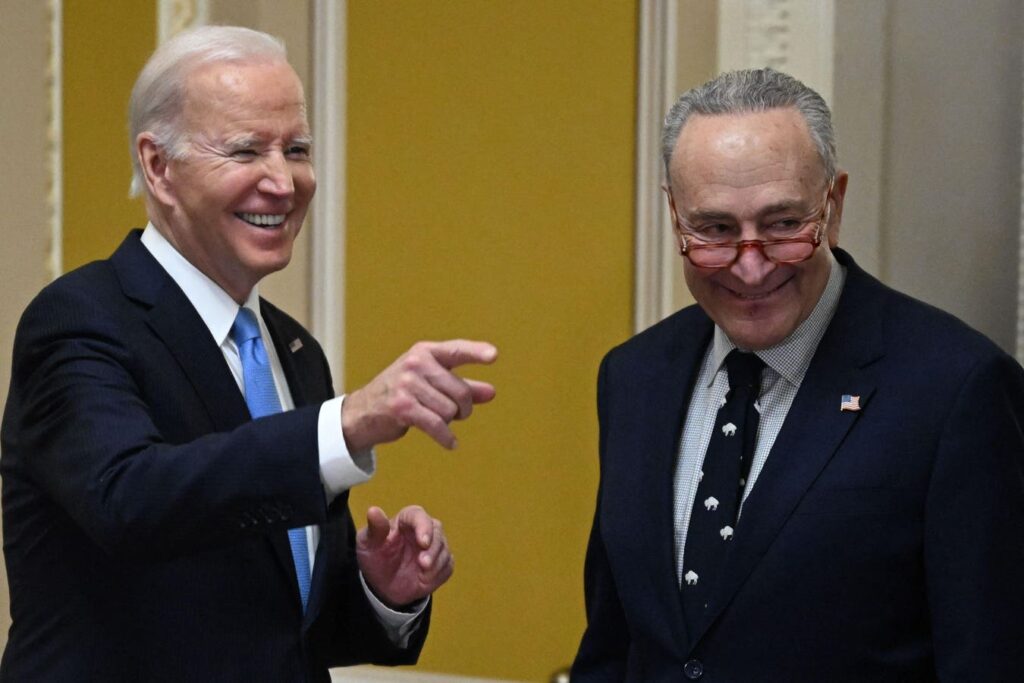

On Wednesday, outgoing Senate Majority Chuck Schumer announced his intention to bring the House-passed “Social Security Fairness Act” up for a vote before the end of the year. While the bill may sound good and have some admirable goals, passing it now as written would undermine the future of Social Security. It would be both political malpractice and bad governance for Democrats to rush this bill into law as their final act before handing control of the White House and U.S. Senate to the GOP in January.

Social Security is currently built around two core principles. The first is that workers should receive benefits based on what they paid into the program. Although this principle is heavily strained today, as workers have not paid enough in Social Security payroll taxes to cover the cost of benefits for many years now, benefits are calculated based on the average wages upon which workers paid payroll taxes over their careers. The second principle is that the benefit formula is progressive, meaning workers with lower lifetime incomes receive a greater benefit relative to the money they earned (and paid into the program) compared to higher earners.

At issue are two provisions, known as the windfall elimination provisions (WEP) and government pension offset (GPO), that attempt to enforce these principles fairly for people who spend part of their career working for state and local governments in jobs that offer pension benefits in lieu of Social Security. Earnings from these jobs are considered “uncovered,” which means workers don’t have to pay payroll taxes on the income, but those earnings also aren’t taken into account for Social Security’s benefit formula. WEP and GPO are intended to prevent someone who consistently earned a $100,000 annual salary over a career that was split evenly between covered and uncovered jobs — and thus would be treated by the benefit formula as if they received a $50,000 over their whole career — from getting a higher return on their payroll-tax contributions than someone who consistently earned $60,000 in covered employment.

Critics argue that WEP and GPO, as currently designed, are unfairly punitive to certain low-income public-sector workers — and they’re not wrong. But simply repealing the provisions, as the misleadingly named Social Security Fairness Act does, would give a windfall to even highly compensated public employees who already receive generous pensions. Even worse, it would increase Social Security’s financial shortfall by nearly $200 billion over the next 10 years and expedite the date of the program’s insolvency, leading to automatic benefits cuts for everyone who depends on the program.

Maya MacGuineas, president of the non-partisan Committee for a Responsible Federal Budget, recently put it best: “At a time when we’re already borrowing $2 trillion a year and retirees are already slated to see a 21% benefit cut — an average of $16,500 for a newly retiring couple in 2033 — in just nine years, why would we make it a 22%, $17,300 cut in eight and a half years instead?” But it’s not just the budget hawks at CRFB: left-leaning groups, including the Urban Institute and the Center on Budget and Policy Priorities, have also opposed the Social Security Fairness Act’s policy changes.

Yet even Democrats who dismiss their concerns and believe the Act is good policy should be wary about how it is likely to backfire politically. Benefits would start being increased during a time in which Republicans have control of the U.S. House, Senate, and presidency — meaning they are likely to get the political credit. This wouldn’t be the first time voters credited one administration for its predecessor’s actions: a New York Times survey earlier this year found that roughly one in six voters blamed President Biden for the overturning of Roe v. Wade because it occurred during his presidency, even though the policy change was carried out by Supreme Court justices who had been appointed by Donald Trump.

There is a better path forward. As the outgoing leader of the party who can take the political heat from disappointed advocates, President Biden should issue a statement of administrative policy that he won’t sign the bill. The message could be straightforward: although he supports the effort to reform or repeal WEP and GPO, Biden cannot in good conscience end his presidency by signing a bill to expedite Social Security’s insolvency. Even in the absence of such a statement, Democratic senators who care about the long-term health of Social Security can privately relay similar concerns to Leader Schumer and urge him to reconsider his plan to hold a vote within the week.

The next Congress could then work to pair the Social Security Fairness Act with other programmatic changes to improve rather than worsen solvency. Even better, lawmakers could reform WEP and GPO in a way that is both fairer and more fiscally sustainable than outright repeal, as I and others have previously advocated. Either approach would be a better move for Democrats than making their final act in power one that undermines the health of the nation’s largest retirement program while providing the party no obvious political benefit.

Read the full article here