After the devastating wildfires in Los Angeles, it will take years for housing there to right itself. Resiliency data shows shifts are starting now and that the impacts will not only create waves across the country but permanent patterns.

When a place like Los Angeles is faced with rebuilding, there are new challenges that get tangled with the market’s old housing challenges. Stakeholders are faced with crippling bureaucracy, and higher than normal costs for products and labor, plus the remediation efforts on top of that.

While reconstruction has its challenges, each climate event leaves lasting impressions on the housing market in many more ways.

Resiliency’s Impact On Affordability

The chief economist at Zillow, Skylar Olsen, is studying the data on the Los Angeles market to understand the impact of the recent wildfires both today and into the future.

Los Angeles suffered from a housing shortage even before the fires. According to Zillow’s research, the metro area was short about 337,000 homes. In October 2024, Zillow reported that only 1.6% of for-sale listings in the Los Angeles metro area were comfortably affordable to a median-income household.

“Los Angeles has long faced an affordability problem,” Olsen wrote. “Rental affordability in Los Angeles is the third worst in the country. An LA metro area renter making the median income would spend 36.5% of their income on a typical rental, which is sixth highest in the country at $2,954.”

Driving costs higher is the fact that the Los Angeles rental market is tight with rental vacancy rate at 5% at the end of last year, compared to 7% nationally.

Driving costs even higher is the displacement from the fires.

“Rents turned up in January,” Olsen said. “The price jumps weren’t massive, but they were bigger than we’d expect given the trends coming into the month.”

A similar climate event on a longer time frame are the wildfires in Lahaina that occurred a year and a half ago. Zillow shows that the impact on that market has been severe. The typical rent in Maui County hit $3,739 in December 2024, an increase of 8% year over year. Rents in Lahaina reached $4,319, well above the national average of $1,965.

In addition, a recent report from First Street, a financial risk data company, shows even more alarming long term impacts on a fire impacted community. A wildfire in Paradise, CA, caused a 37% increase in insurance, a 69% drop in population, and a 42% drop in property values after five years.

Insurance And Resiliency Face Off

While insurance companies are evaluating if they can continue to cover these disaster prone areas, homeowners have to decide if they can afford to continue to live in these areas.

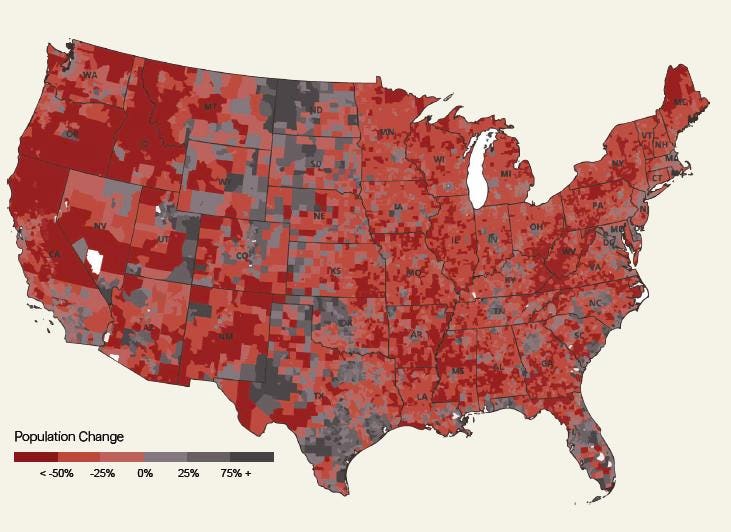

The First Street report states that most homeowners won’t want to absorb the price increases. Its climate migration projections predict that more than 55 million Americans will voluntarily relocate within the U.S. to areas less vulnerable to climate risks by 2055, starting with 5.2 million in 2025.

Not only are they scared out of living in these locations, but the added costs of insurance are crippling some homeowners. The report shows that from 2013 to 2022, insurance skyrocketed from around 8% to more than 20% of mortgage costs.

For decades, Texas, Florida and California have been the most prized locations to migrate to for retirement. But, after hosting more than 40% of the country’s natural disasters since 1980, home buyers are reconsidering these dream locations.

The coasts are the most threatened by insurance hikes. First Street’s report shows that the five cities with the highest insurance increases are Miami (322%), Jacksonville (226%), Tampa (213%), New Orleans (196%), and Sacramento (137%).

The issue cannot be solved easily. Insurance has a role in the loan process, in the design of the house, the permitting, the building code, on and on. A deeper dive on this is available here.

Home Resiliency Features

Homebuyers already are being selective about a next home purchase in relation to climate preparedness. Zillow data shows that certain climate resilient features impact the sales price of a home and the time it spends on the market.

For example, if a home has a generator, it will see a boost of 1.5% on the sales price. A safe room will boost the price of the home, but it also has a negative impact on the time on the market. You’re most likely to see a safe room in Oklahoma City, and when you do, you know that the home is at risk for tornados, but if you are moving there, you’ll pay extra for that feature.

The same thing goes for fire protection, which adds four days to the average time on the market, whereas a sump pump helps speed up the sales process by a day.

Housing Resiliency Innovation

Flooding is one climate risk that is impacting more homes on a regular basis. Just this week, a major storm front with rain and snow caused flooding in Kentucky that resulted in 14 fatalities. Yet, proactive housing solutions for flooding are rare.

One solution is a floating home. Floating homes exist in several locations around the world now, proving to offer safety and security during hurricane events and in flood-prone areas. One such community, Schoonschip, was completed in the Netherlands in 2020 with 30 homes for 144 people. In the Philippines, an indigenous group built homes that are on the ground during dry season and can float when it floods.

There also is a retrofit program, called the Buoyant Foundation Project, that can convert an existing home into flood resistant.

More land-based developments are designing in new resiliency standards for the increasing risks. Homes in Fort Meyers, Florida-based Babcock Ranch are designed and engineered to exceed local standards. The homes are built 30 feet above sea level rise and can withstand category four hurricanes. Another Florida-based community, Hunters Point, also is designing homes to withstand category four hurricanes.

Floating Town is another consulting and development group that brings these innovations to marina revitalization projects, to remote communities, and to coastal locations for hurricane readiness. The company estimates that there is a big market opportunity on the coasts, along with the areas that need to adjust to seasonal flooding.

The Future

First Street’s report projects changes out to 2055, stating that in the next 30 years, 84% of all census tracts could experience negative property value impacts from climate risk. In dollars, that adds up to a whopping $1.47 trillion in net property value losses due to insurance pressures and shifting consumer demand.

Now that we have those insights, it’s time to consider what is preventable and how. Efforts like REBUILD L.A., a consulting program hosted by UCLA Anderson School of Management, is tackling organizational challenges focused on wildfire recovery and resilience, and supporting new initiatives. And, programs like Reconstructing LA Together are compiling targeted resources to ease the process, potentially (or hopefully) leading to better processes without a disaster.

I will be part of a panel session at the 2025 SXSW Conference, Building and Protecting Homes in a Changing Climate: Challenges and Strategies, scheduled Tuesday, March 11, to discuss new solutions. The panel also features Olsen from Zillow.

During the session, we’ll not only have new resiliency data from Zillow, but we’ll talk about the innovations in building code and insurance.

It’s a new age in housing where resiliency is ruling the market. It’s time for big changes to make that feasible.

Read the full article here