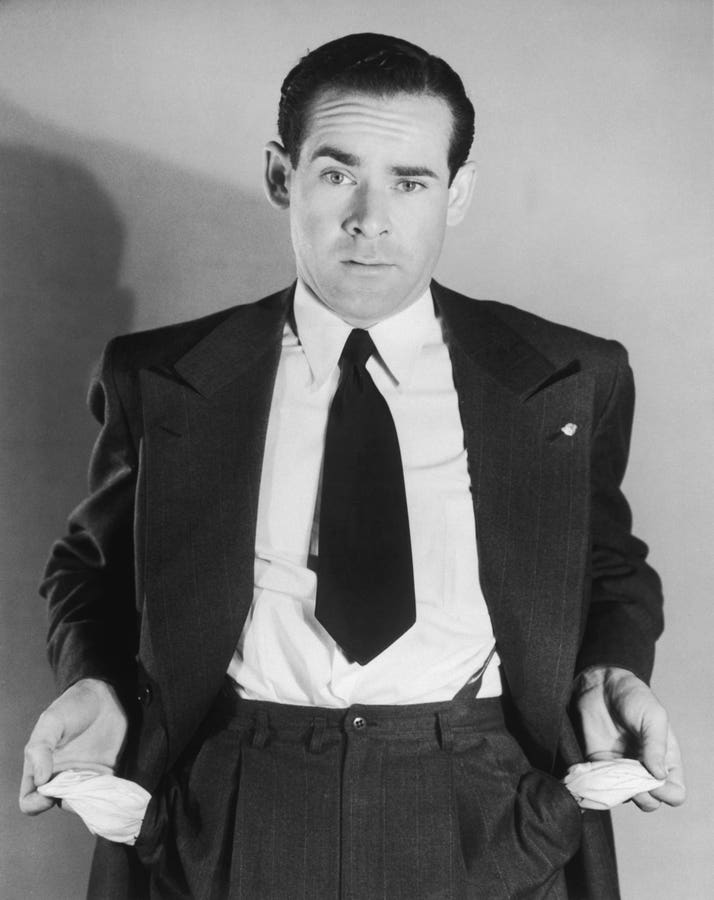

We’ve all seen him. That charming, confident man with a nice watch, smooth talk, and big dreams—who turns out to be financially allergic to stability. He talks like a CEO but lives like a couch surfer. Sister, let’s not get it twisted: broke men rarely look broke anymore. They come in designer sneakers and “business plans” that have been in beta since 2019. So how do you know when a man is financially fraudulent? Let’s break it down—with receipts.

1) He Lives On Lifestyle Credit: He picks up dinner at Nobu, but he’s dodging his student loan payments. That’s not wealth—it’s debt cosplay.

In fact, nearly 60% of U.S. credit cardholders live paycheck to paycheck, and half carry revolving credit card debt from month to month, according to a 2024 Bankrate report.

Ask yourself: Is he spending money, or just swiping and praying?

2) He’s Always In Between Something: He’s “between projects,” “launching a startup,” or “waiting on a big opportunity.” Sound familiar?

While unemployment overall is low, the unemployment rate for adult men was 3.8% as of March 2025. That means most are working—if he’s not, ask why.

Ambition is attractive. But let’s be honest, if he’s been “almost successful” for 7 years, you’re not dating a visionary—you’re funding a hobbyist.

3) He Uses Love To Dodge The Money Talk: When you ask about finances, he pulls the “love isn’t about money” card. Cute but misleading.

According to IDFA, money is the one of the leading cause of divorce in the U.S., right behind infidelity and incompatibility. If you can’t talk about money early on, that’s not romance—it’s a red flag.

4. He Talks Assets But Has None: Crypto, NFTs, “angel investing”—he knows all the buzzwords, but has no real retirement savings.

He’s not alone. A whopping 45% of U.S. households have no retirement savings at all. That’s not “starting late”—that’s ignoring the basics.

Ask yourself: Has he shown you an actual portfolio or just tweeted about Dogecoin in 2021?

5. He Moves In Fast And Stays: He “loves being around you,” but somehow he’s using your Wi-Fi, eating your groceries, and asking to borrow your car. He might say “we’re building a life together,” but you’re the only one contributing anything real.

And this trend is growing: According to the Pew Research Center, inn 2023, 52% of U.S. men aged 18-29 lived with one or both parents.

Translation: some men are outsourcing adulthood—and hoping you’ll be the upgrade.

So don’t confuse confidence with capability.

Some of the brokest men come wrapped in charm. They’re confident, attentive, and know how to say just enough to make you ignore the warning signs.

But next time you feel swept off your feet, ask yourself:

- Does he have a financial foundation—or just a fantasy?

- Am I building with a partner—or babysitting a grown man?

Because love should make your life easier—not more expensive.

Read the full article here