President Donald Trump’s new Consumer Financial Protection Bureau acting director Russell Vought has taken a mallet to the agency, according to reports over the weekend.

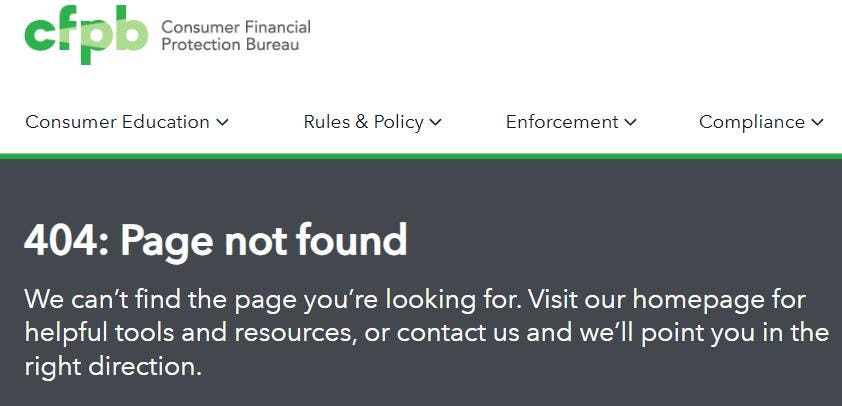

The capper seems to be something done to the CFPB’s homepage: the superimposition of an Internet 404 error message, meaning the page couldn’t be found. Except it’s an image fit in, the rest of the page is in place, and the links work. Consumers might not realize it and give up on looking for resources or services.

I reached out to the agency through its media contact email and did not get a reply before Sunday night, but will update with any future response.

The CFPB has become important through sanctions of financial companies and actions to address injuries to consumers. It was authorized by Congress through the Dodd–Frank Wall Street Reform and Consumer Protection Act, passed in 2010 as a reaction to the financial crisis of 2007 to 2008, and the resulting Great Recession.

What makes the approach stand out is that the administration has already made changes in a number of government web pages to eliminate pronouns from government emails and remove resources for gender diversity, as the Associated Press reported. And 404 Media reported a directive telling NASA personnel to remove mentions of DEI (diversity, equality, inclusion), indigenous people, environmental justice, and women in leadership from the agency’s website.

Such activity isn’t new. In 2017, searches of the White House website showed no results for some search terms, including “LGBT,” “Lesbian,” “Gay,” “Bisexual,” and “Transgender.” The webpage for the Office of National AIDS Policy completely disappeared. KFF reported a week ago that several government datasets, including some widely used in healthcare research and policy making, had gone offline. “By Sunday February 2, 2025, some of the landing pages started to come back online – now with a warning message: ‘CDC’s website is being modified to comply with President Trump’s Executive Orders,’ suggesting there could be future changes,” they wrote.

In context, the CFPB website graphical addition seems of low importance given some of the more major changes Vought has ordered, including suspension of all activities, a funding cut, and a plan to close its headquarters at least temporarily, Reuters wrote.

“This latest attempt to kill the consumer bureau is another slap in the face for all Americans who depend on basic financial products and services,” Dennis Kelleher, head of Better Markets, which advocates for stricter government oversight of the financial sector, told Reuters.

On Saturday, Vought issued a memo ordering stuff to “cease all supervision and examination activity,” Reuters reported.

A Sunday email to staff said that the agency’s Washington, D.C. headquarters would be closed from February 10 to 14, 2025, reported The Wall Street Journal. The email also said, “Employees and contractors are to work remotely unless instructed otherwise from our Acting Director or his designee.”

On Sunday, Vought wrote in a post on X, “The CFPB has been a woke & weaponized agency against disfavored industries and individuals for a long time. This must end.”

In another post, Vought wrote, “Pursuant to the Consumer Financial Protection Act, I have notified the Federal Reserve that CFPB will not be taking its next draw of unappropriated funding because it is not ‘reasonably necessary’ to carry out its duties. The Bureau’s current balance of $711.6 million is in fact excessive in the current fiscal environment. This spigot, long contributing to CFPB’s unaccountability, is now being turned off.”

Congress directly funded the agency through the Federal Reserve, so saying that funding was “unappropriated” wouldn’t be accurate.

Read the full article here