By GuruFocus

The insurance conglomerate revealed its 4th-quarter portfolio update, revealing that it entered a new position in an alcoholic beverage company. Berkshire also trimmed its holding in Bank of America.

Warren Buffett (Trades, Portfolio) recently submitted the 13F filing for the fourth quarter of 2024, providing insights into his investment moves during this period. Buffett is the most respected and successful investor in history, having been called “The Oracle of Omaha” for his impressive investing prowess. Buffett studied under the legendary Benjamin Graham at Columbia University; Graham had a major impact on Buffett’s life and investment strategies. Buffett is Chairman of the miraculous Berkshire Hathaway, which he built from a textile company into a major insurance conglomerate. Berkshire follows a value investing strategy that is an adaptation of Benjamin Graham’s approach. His investment strategy of discipline, patience and value consistently outperforms the market and his moves are followed by thousands of investors worldwide. Buffett seeks to acquire great companies trading at a discount to their intrinsic value, and to hold them for a long time. Berkshire invests only in businesses that Buffett understands, and always insists on a margin of safety. Regarding the types of businesses Berkshire likes to purchase, Buffett stated, “We want businesses to be one (a) that we can understand; (b) with favorable long-term prospects; (c) operated by honest and competent people; and (d) available at a very attractive price.”

Summary of New Buy

Berkshire took a new holding in Constellation Brands Inc, with 5,624,324 shares. The position accounts for 0.47% of the portfolio with a total value of $1.24 billion.

Key Position Increases

Buffett’s firm also increased stakes in a total of 5 stocks, including Domino’s Pizza Inc. Berkshire added with 1,104,744 shares, bringing the total to 2,382,000 shares. This adjustment represents a significant 86.49% increase in share count, a 0.17% impact on the current portfolio, with a total value of $999,868,320.

The second largest increase was Occidental Petroleum Corp, with an additional 8,896,890 shares, bringing the total to 264,178,414. This adjustment represents a significant 3.49% increase in share count, with a total value of $13,053,055,440.

Summary of Sold Out

Berkshire completely exited 3 of the holdings in the fourth quarter of 2024, including the selling of all 39,400 shares of SPDR S&P 500 ETF Trust and all 43,000 shares of Vanguard S&P 500 ETF.

Key Position Reduces

Buffett’s insurance conglomerate also reduced positions in 8 stocks, including the sale of 117,449,720 shares of Bank of America Corp. The transaction resulted in a -14.72% decrease in shares and a -1.75% impact on the portfolio. The stock traded at an average price of $44.07 during the quarter and has returned 2.90% over the past 3 months and 6.87% year-to-date.

Berkshire also trimmed its Citigroup Inc position by 40,605,295 shares, resulting in a -73.5% reduction in shares and a -0.96% impact on the portfolio. The stock traded at an average price of $67.49 during the quarter and has returned 24.85% over the past 3 months and 20.88% year-to-date.

Portfolio Overview

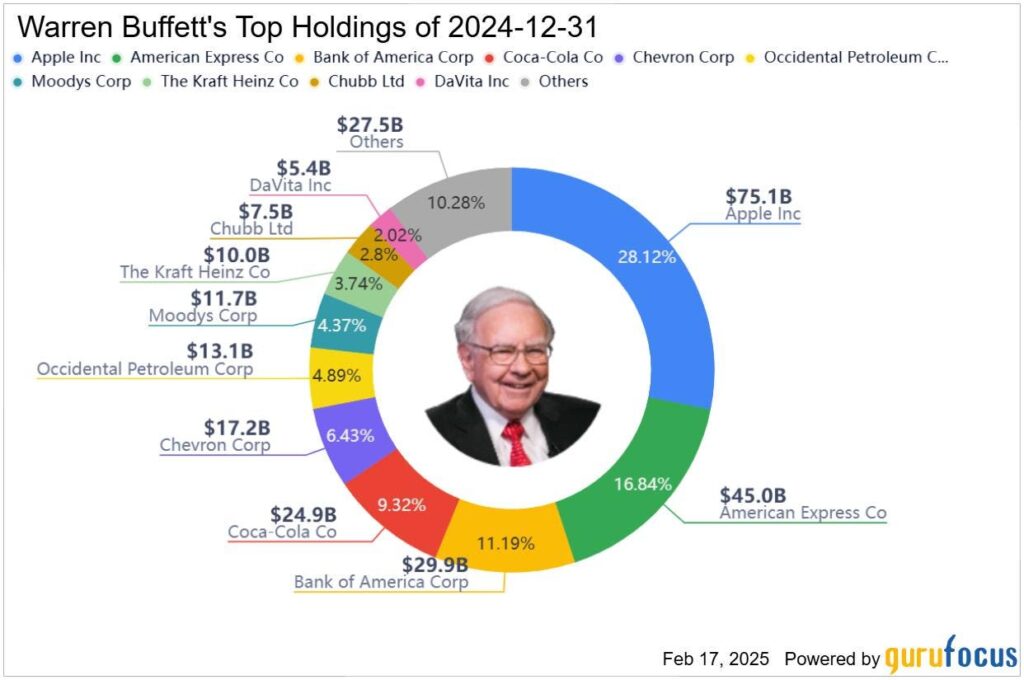

At the fourth quarter of 2024, Berkshire’s portfolio included 39 stocks, with top holdings including 28.12% in Apple Inc, 16.84% in American Express Co, 11.19% in Bank of America Corp (BAC), 9.32% in Coca-Cola Co, and 6.43% in Chevron Corp.

The holdings are mainly concentrated in 8 of all the 11 industries: Financial Services, Technology, Consumer Defensive, Energy, Communication Services, Healthcare, Consumer Cyclical, and Industrials.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

Read the full article here