Key News

Asian equities were mixed but mostly higher overnight as Thailand and Taiwan outperformed while Malaysia and Singapore underperformed.

Markets opened lower in Hong Kong, only to swing sharply higher following positive comments from the National Development and Reform Commission (NDRC) on high-quality development and supporting consumption and employment. Unfortunately, the Hang Seng ended the session close to flat.

Mainland China-based restaurant chain Green Tea Group will go public on the Hong Kong Stock Exchange after its fifth attempt in four years. The company has no business outside of China, so it does not expect any impact from trade tensions. We have seen some IPOs of China-based companies in Hong Kong and New York, after and despite “Liberation Day” tariffs. This shows how consumer-oriented China’s economy has become, enabling these firms to weather the tariff storm. Meanwhile, the Hong Kong Stock Exchange is amending its rules to make it easier for firms to list there, especially US listed firms that are seeking a secondary listing on the exchange.

Internet earnings reports for Q1 are due to start in mid-May. However, TAL Education already reported, as it tends to be early in the cycle, and missed estimates on revenue, net income, and earnings per share. The private tutoring and educational technology company has idiosyncratic risks, so we do not think its results are indicative of the internet sector overall.

Health care was a top-performing sector in both Mainland China and Hong Kong overnight. The industry continues to rally, with significant improvements in regulatory posture and government support.

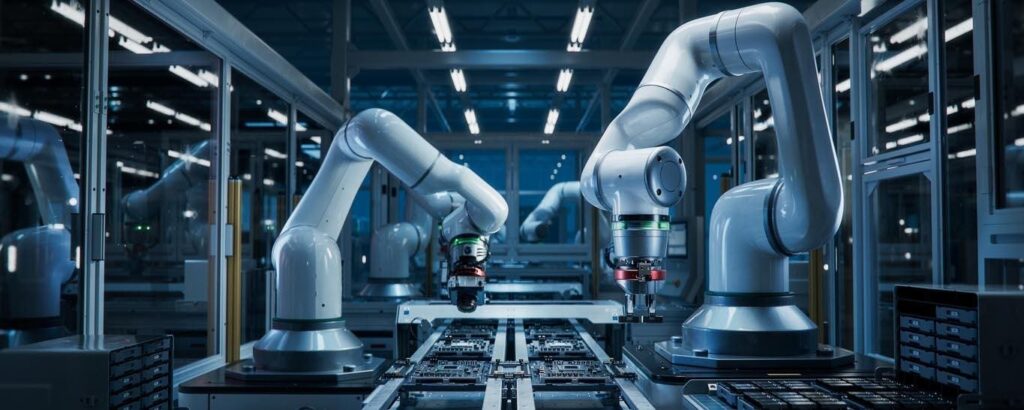

Humanoid robot plays outperformed in Hong Kong. Jiangsu Guomao Reducer Inc., which makes small motors used for robots, gained +3.37% in Mainland China. The humanoid robotics theme has become a hot topic in China’s markets after robots were displayed dancing during the CCTV Gala, a massive TV event celebrating Lunar New Year, and ran in the Beijing Half Marathon.

Mainland investors were net sellers of Hong Kong-listed stocks and ETFs via Southbound Stock Connect, which may have led to the market’s decline in the second half of the session.

New Content

Read our latest article:

New Drivers For China Healthcare: AI Med-Tech Innovation, Cancer Treatment, & Favorable Balance of Trade

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.27 versus 7.29 yesterday

- CNY per EUR 8.30 versus 8.29 yesterday

- Yield on 10-Year Government Bond 1.62% versus 1.65% yesterday

- Yield on 10-Year China Development Bank Bond 1.66% versus 1.69% yesterday

- Copper Price +0.30%

- Steel Price -1.21%

Read the full article here