The data and calculations for this article are stated as of 1/28/25.

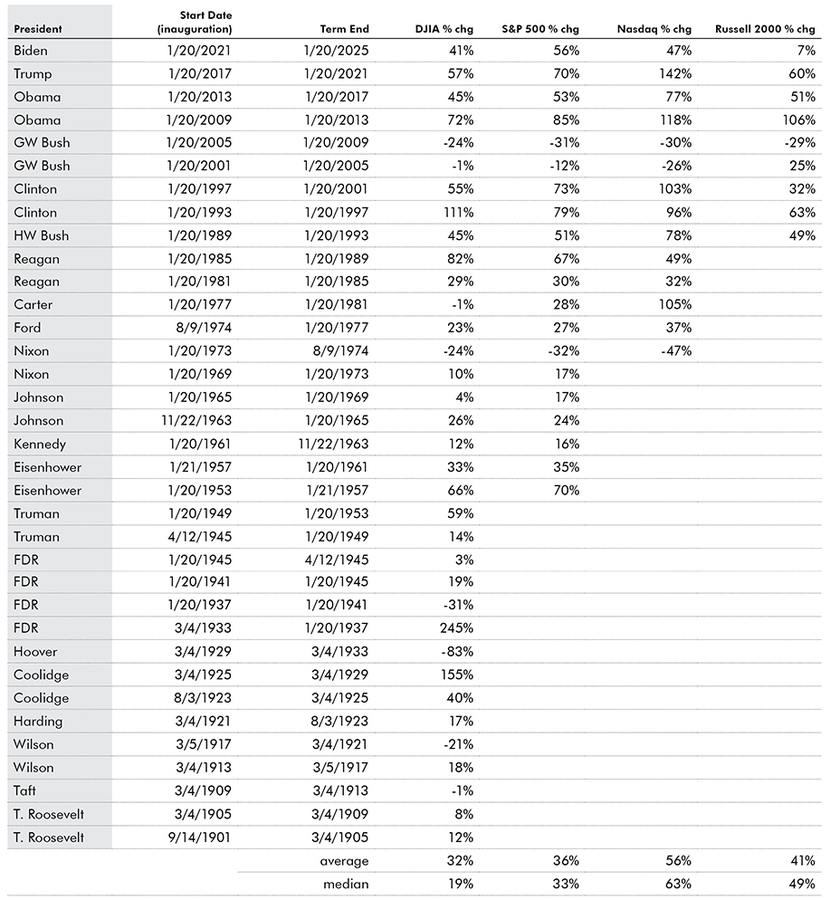

This year has started with a new presidential administration and a feeling of optimism on Wall Street. Last year was a rewarding one for investors. In fact, President Biden’s full term saw the S&P 500 rise 56%. While this was not as strong as President Trump’s first term, it was better than President Obama’s second term and the long-term average. On the table below are key U.S. equity index returns during each presidential term from 1900–2025. This is using the start date as the day of the incoming (or repeating) pres- ident’s inauguration, and the end date when each term ended. The median return for the S&P 500 over a four-year presidential term is 33%. See the DJIA (1900–2025), Nasdaq (1973––2025), and Russell 2000 returns below as well.

On an annualized basis and full-term basis, performance above about a 5.5% annualized return is ahead of the overall market return for the past 125 years. The chart below plots the return by presidential term for the DJIA.

The next table shows the S&P 500, and the first year of each term compared to the full term since 1953. Only two presidents, George W. Bush and Richard Nixon posted a less than 10% return for their full term. Overall, the first year does tend to be a decent indication of how the full term will play out, with some exceptions.

Although it is too soon to evaluate groups and stocks since President Trump’s recent inauguration, we can look at what the market has favored since the election results in early November 2024. This week has certainly altered the makeup of the market, so it is an appropriate time to re-evaluate.

With regards to market capitalization, larger stocks continued to be favored over small ones with the Vanguard Mega Cap Growth ETF outperforming the Russell 2000 by roughly 360 basis points. Small caps are continuing their trend of underperformance. We will likely need improvement in the domestic economy for this trend to reverse.

With regards to style, growth remains the dominant style in the market with large cap growth stocks outperforming large cap value by a convincing 380 basis points. Much like small cap, value will probably need an acceleration in the domestic economy to take market leadership from growth.

By sector, Consumer areas have fared the best, followed by Transportation, Technology, and Capital Equipment. In particular, Consumer Cyclical, aided by a resilient job environment and continued consumer spending, has led the market. Defensives have continued to lag, along with Basic Materials. It remains to be seen how much the picture will change given the huge selloff in data center and artificial intelligence infrastructure-related names this week.

Also, we would keep in mind that Technology’s performance is stretched versus many sectors since the beginning of 2023 and may be ripe for some reversion with the emergence of DeepSeek, a potential catalyst. The chart below shows how great the Technology outperformance has been, over 40 percentage points versus the S&P 500. While we remain positive on Technology as a whole, there has clearly become more dispersion in the sector, possibly benefiting other areas of the market like Financials, Cyclicals and Health Care.

Lastly, diving deeper and examining by subgroup and/or theme, here are the winners and losers through the first 60 days post-election. Bitcoin is one of the leading themes post-election as is Quantum Computing, Aerospace, Consumer Cyclical and Software. In particular, we are hopeful that Software can be one of the market leaders in 2025. Within Software, cyber security and cloud computing are both areas with strong breadth and should thematically be strong areas of potential investment. Also, leisure and entertainment has good breadth, from cruise line operators and food delivery to movies and music.

Kenley Scott, Director, Global Sector Strategist at William O’Neil + Co., made significant contributions to the data

compilation, analysis, and writing for this article.

The William O’Neil + Co. Research Analysts made significant contributions to the data compilation, analysis, and writing for this article.

Disclaimer

No part of the authors’ compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed herein. William O’Neil + Co., its affiliates, and/or their respective officers, directors, or employees may have interests, or long or short positions, and may at any time make purchases or sales as a principal or agent of the securities referred to herein.

William O’Neil + Co. Incorporated is an SEC Registered Investment Adviser. Employees of William O’Neil + Company and its affiliates may now or in the future have positions in securities mentioned in this communication. Our content should not be relied upon as the sole factor in determining whether to buy, sell, or hold a stock. For important information about reports, our business, and legal notices please go to www.williamoneil.com/legal.

©2025, William O’Neil + Company, Inc. All Rights Reserved.

Read the full article here