In the last few weeks, we’ve talked a lot about “hated” dividends set to soar as mainstream investors get it wrong on Trump 2.0.

Last week, we covered utility stocks, “bond proxies” that look great here, and a 7.6%-yielding utility fund to buy now.

This week we’re shifting to another despised corner of the market, again thanks to the new administration—healthcare. But our play isn’t some middling payer, like 3%-yielding Johnson & Johnson (JNJ).

A 13% Dividend That Grows

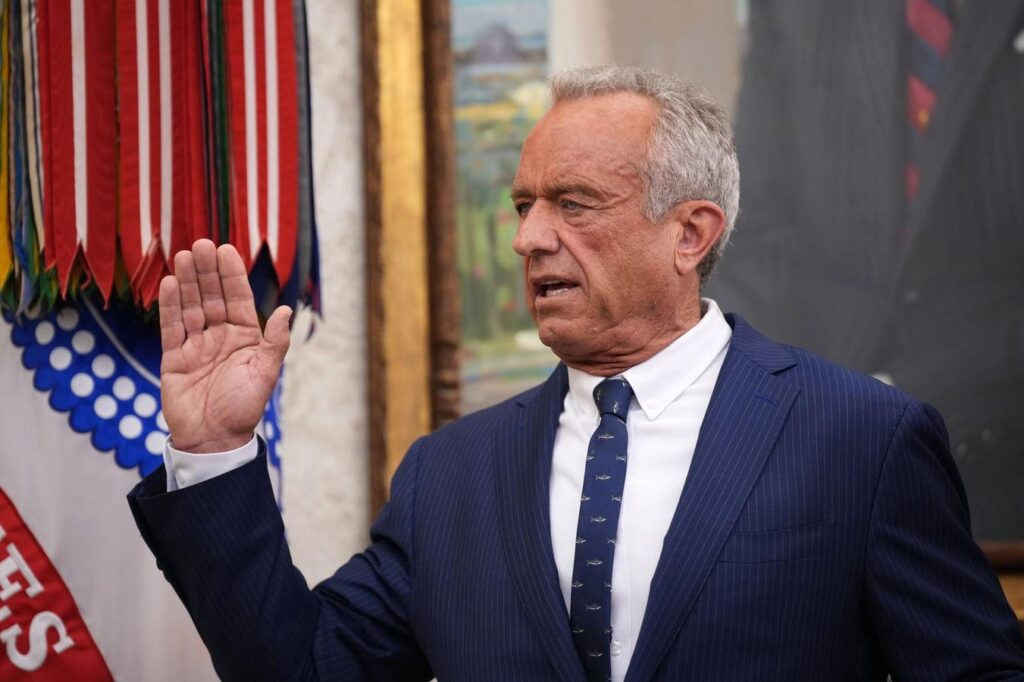

Instead, we’re going to drop a “1” in front of that “3” and buy a 13%-yielding healthcare closed-end fund (CEF). It’s the perfect play on concerns around RFK Jr.’s confirmation as HHS secretary and Trump’s threatened 25% tariffs on pharma imports.

That would be the BlackRock Health Sciences Term Trust (BMEZ), the CEF behind that 13% divvie. Not only is its payout in the double digits, but the fund pays monthly and has a history of raising its dividend, too:

BMEZ launched in 2020, as the pandemic boosted pharma. Management hiked the payout (and dropped a special dividend, to boot) in 2021.

The fund did lower its payout after the 2022 mess, leaving itself room to buy bargains. But look at the right side of the chart above: BMEZ has since boosted the payout to new highs—up north of 75% from its inception just five years ago.

Not bad for a 13% payer!

The fund bolsters its income stream by selling covered-call options on its portfolio (currently about 24% of its holdings). Under this strategy, BMEZ sells investors the option to buy its holdings at a fixed price and date in the future.

If the stock hits that price, it’s sold or “called away.” If not, nothing happens. Either way, BMEZ keeps the fee it charges for the option. It’s a canny way to generate extra cash, especially when markets turn choppy.

BMEZ Can Outmuscle RFK …

The growing 13% dividend is the start of our buy case here. Let’s move on to two other factors—RFK and tariffs—to see how these are giving us an opportunity to buy BMEZ at a discount to net asset value (NAV), currently around 3.1%.

On the campaign trail, Trump said he was going to let former candidate turned supporter RFK Jr. “go wild on health.” A big “uh-oh” for healthcare stocks?

Wall Street didn’t wait around to find out. It dumped healthcare after the election and especially after RFK was nominated to run the Department of Health and Human Services. Pharma stocks have recovered a bit, but they’re still behind the S&P 500 since November 5, as of this writing.

There’s a scenario, however, in which this is bullish for the biotech and medical-device makers that are the vast majority of BMEZ’s holdings. Check out how BMEZ’s top-five holdings performed during Trump 1.0:

These are companies that benefit from lower regulation. They returned 226%, 179%, 141%, 54% and over 1,000% during the first four years under Trump!

Of course, Trump 2.0 isn’t the same as Trump 1.0, but that could also work in our favor, with the trend toward less regulation likely to run even faster now than it did then.

BMEZ is a neat way for us income investors to bet on a “rhyme” of Trump 1.0 for the stock-price gains that power this payout.

… And Turn the Tables on Tariffs, Too

Now let’s talk tariffs, which could be a drag here, but there’s more under the hood. Trump has proposed 25% tariffs on pharma imports. But as we all know, he has a history of using tariffs as bargaining chips, as opposed to actual policy. He also said he’d allow some time for these companies to move production to the US, something we haven’t heard often with his other threats.

Moreover, tariffs continue to be a moving target: Believe it or not, the only new levy in place today is a 10% tax on all imports from China. This took effect February 4. Announced tariffs on Canada and Mexico are currently suspended.

We don’t know what will happen here, but bear in mind that unlike, say, cars, pharma companies’ products must be bought on a regular basis to keep the healthcare system running. That could work against the idea of a prolonged tariff, especially given Americans’ sensitivity to high healthcare costs.

Buybacks Help Wipe Out BMEZ’s Discount

We’re also following the lead of BlackRock itself here. Under an agreement with activist investor Saba Capital Management, BlackRock recently announced a tender offer approving the repurchase of up to 40% of BMEZ’s outstanding shares.

The intent here is to close the CEF’s “discount window,” bolstering the fund’s market price in the process.

The fund should keep grinding higher thanks to the buyback and 13% yield. It’s trading just above $16 as I write this, and I’m recommending that CIR members pick it up on dips below that level.

Any bigger drops on pharma-related news (RFK- or tariff-related) would of course be a signal to buy even more of this “buyback-powered” 13% payer.

Brett Owens is Chief Investment Strategist for Contrarian Outlook. For more great income ideas, get your free copy his latest special report: Your Early Retirement Portfolio: Huge Dividends — Every Month — Forever.

Disclosure: none

Read the full article here