By Grahamites

Summary

- Nike has under-performed due to distribution revamp, product design shifts, and backlash in China, impacting revenue and margins.

- Nike’s valuation is low, with a Schiller P/E near a 15-year low and a dividend yield close to a 15-year high.

- Despite the challenges, Nike’s stock appears undervalued, offering potential for patient investors with its dividend yield and share repurchase program.

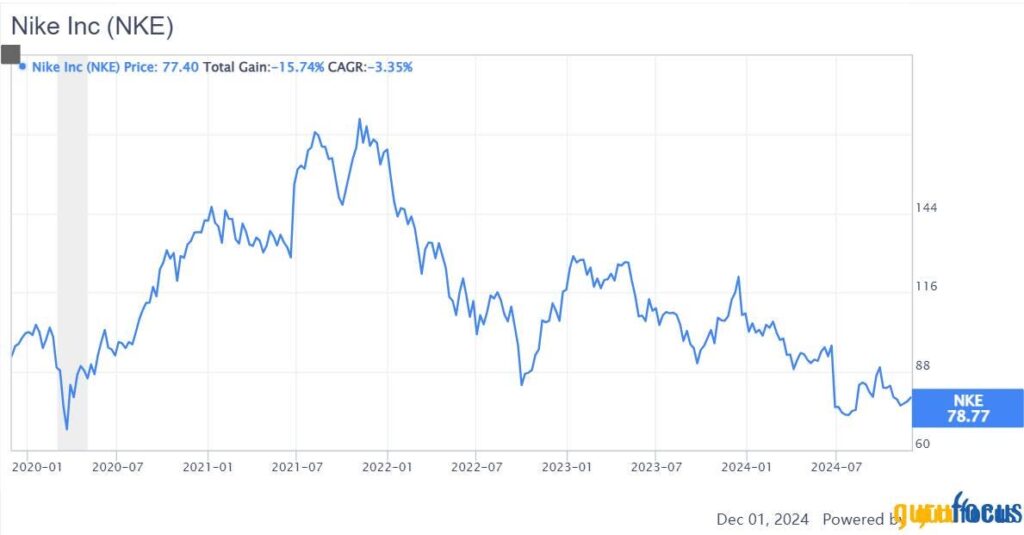

Nike (NKE, Financial), the global athletic shoe and apparel giant, has significantly underperformed the index over the past three and five years. This prolonged period of underperformance is unfamiliar to Nike’s long-term shareholders. During the past 5 years, Nike went through a significant distribution system transformation, faced significant competitive threats in the running footwear market, and experienced backlash in the Greater China region during the COVID pandemic. In this article, I will analyze Nike’s challenges in detail and share my thoughts on Nike’s valuation.

Nike’s recent under-performance

As an iconic global brand, Nike needs no further introduction. The company is the world’s largest sports shoes and apparel company with over $50 billion in revenue for FY 2024. After peaking in 2021, a high valuation coupled with disappointing fundamental growth has resulted in the decline of Nike’s share price for three years in a row. It’s hard to remember the last time Nike’s stock has performed so badly for such a long period of time.

The stock price decline is justified to some extent. Nike’s revenue has increased mildly since FY2021. However, Nike’s margin has declined from 17% to just above 10% . This is why Nike’s EPS has stayed almost flat compared to FY 2021.

To make things worse, earlier this year, Nike’s management team withdrew its FY25 guidance due to the company’s ongoing transitional challenges. After the retraction of the previous guidance, investors are even more concerned with Nike’s ability to restore growth.

Nike’s recent challenges

Nike is currently facing multiple challenges. The most significant one is the revamp of its distribution channels. Back in 2017, Nike decided to radically change its distribution channel by moving more sales from the traditional wholesale channel to its directly owned stores. The idea behind this DTC (Direct-to-Consumer) strategy is to better understand the consumers and to better serve them. The COVID-19 pandemic has significantly accelerated Nike’s transition to the DTC model, particularly in the United States. Nike’s margin improved as the DTC model eliminated third-party wholesalers from the channel and improved product pricing. Nike also has better control of the inventory, especially for popular products.

However, the problem with the DTC strategy is that in certain areas, Nike’s wholesale partner has a special connection with local communities. When Nike pulled out from the local Dick’s Sporting Goods or Foot Lockers in these areas, it leaves room for Nike’s competitors such as Asics, Hoka, and New Balance. Nike has realized this problem and is taking steps to rebuild its partnerships with key retailers and wholesalers, as mentioned in its Q1 FY25 earnings call.

The second major challenge Nike faces is product design, which is related to the organizational structural change. Specifically, beginning in 2020 under the leadership of former CEO John Donahoe, Nike transitioned from a category-led product strategy to a gender-led one. To support this strategic shift, Nike accelerated its Diversity, Equity, and Inclusion (DEI) initiatives. During COVID, lifestyle products became more popular, especially in the running category. As Nike changed its product design from performance-focused to lifestyle and trend-focused, it lost market share to competitors. New players such as Hoka and On Running took advantage of Nike’s loss of focus in men’s running. Meanwhile, legacy brands such as Asics and New Balance also became very responsive to runners’ needs and gained market share.

The third challenge for Nike is China. Prior to the COVID pandemic, Nike dominated the Chinese sportswear market in almost every single category. However, Nike’s decision to issue a statement related to Xinjiang cotton has angered many Chinese consumers, who switched to domestic Chinese brands such as Li Ning, Anta, and Xtep. These domestic brands have gained market share by offering products that not only resonate with Chinese culture but also leverage China’s huge e-commerce market to reach consumers more effectively. Nike will face a tough challenge to win back Chinese consumers.

Faced with these three big challenges, Nike replaced John Donahoe with a Nike veteran Elliott Hill as the company’s CEO. Investors initially cheered Hill’s return as Nike’s stock jumped 7% on the announcement. However, enthusiasm quickly waned as Hill warned investors about the transitional challenges during the Q1 FY 2025 call.

Nike’s valuation is low

From a valuation perspective, Nike’s current price appears to have reflected a considerable degree of pessimism. Currently, the stock is trading at a Schiller P/E ratio that is close to the 15-year low. This low cyclically adjusted Schiller P/E suggests that the market is pricing in a significant amount of uncertainty about Nike’s future prospects.

On a dividend yield basis, Nike also appears to be cheap as the stock now offers a dividend yield of almost 2%, which is close to the 15-year high. The company also stepped up its share repurchase program recently as the stock became cheaper and cheaper. I think buyback at the current price is a great capital allocation decision.

Conclusion

In conclusion, Nike is facing multiple challenges. Nike’s financial results have been under pressure due to these challenges. With the return of Elliott Hill, Nike may have a chance to get back to growth. From a valuation perspective, Nike’s current stock price has at least partially reflected market pessimism. Meanwhile, the dividend yield and share repurchase program offer additional support for the stock. At the current price, Nike seems like a bargain for patient investors who are willing to bet on the company’s long-term prospects.

Read the full article here