J.M. Smucker has been named a Top Socially Responsible Dividend Stock by Dividend Channel, signifying a stock with above-average ”DividendRank” statistics including a strong 3.7% yield, as well as being recognized by prominent asset managers as being a socially responsible investment, through analysis of social and environmental criteria. Environmental criteria include considerations like the environmental impact of the company’s products and services, as well as the company’s efficiency in terms of its use of energy and resources. Social criteria include elements such as human rights, child labor, corporate diversity, and the company’s impact on society — for instance, taken into consideration would be business activities tied to weapons, gambling, tobacco, and alcohol.

According to the ETF Finder at ETF Channel, J.M. Smucker is a member of the iShares USA ESG Select ETF (SUSA), making up 5.87% of the underlying holdings of the fund, which owns $276,266,872 worth of SJM shares.

Top 25 Socially Responsible Dividend Stocks — Income To Feel Good About »

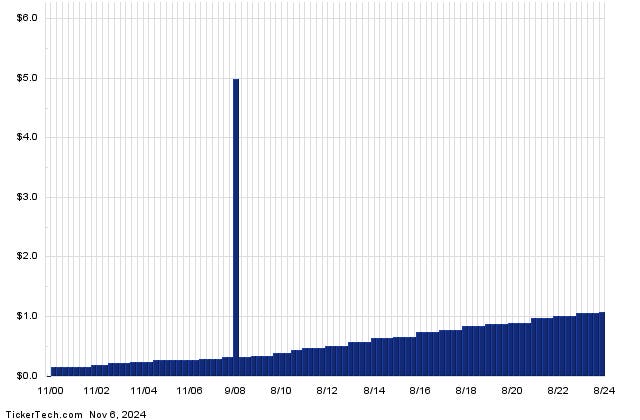

The annualized dividend paid by J.M. Smucker is $4.32/share, currently paid in quarterly installments, and its most recent dividend ex-date was on 11/15/2024. Below is a long-term dividend history chart for SJM, which the DividendRank report stressed as being of key importance. Indeed, studying a company’s past dividend history can be of good help in judging whether the most recent dividend is likely to continue.

SJM operates in the Food & Beverage sector, among companies like Mondelez International, and Kraft Heinz.

Read the full article here