Tesla isn’t just making cars anymore—it’s rewriting what a car is. The Robotaxi.

While legacy automakers focus on electrifying yesterday’s models, Tesla is quietly building something far more ambitious: a closed-loop, vertically integrated robotaxi ecosystem. The vehicle is no longer the product; it’s the delivery mechanism for an autonomous software platform that generates recurring revenue, mile by mile.

If Tesla successfully achieves this, the company will shift from being a car manufacturer to becoming the infrastructure layer of global mobility, relying on the vehicle, the AI brain, the data, and the payments stack. Think AWS, but for transportation.

This endeavor isn’t about selling more cars. It’s about monetizing every idle second of them. Tesla’s critics scoff at its valuation, but if robotaxis work, the real question becomes: is it undervalued?

Why The Robotaxi Model Is Different

Legacy automakers live off one-time transactions. They sell a car and book a margin of around $6,000 on average, and they hope you come back in five to seven years. That’s the model. Tesla, with its robotaxi ambition, is rewriting that model entirely: recurring revenue per mile, not margin per sale.

Here’s the math: A single robotaxi running 70,000 miles a year and charging $0.50 to $1 per mile generates $35,000 to $70,000 in annual revenue. Over a decade, that’s $350,000 to $700,000—from one car. The autonomy, enabled by software, operates continuously without the need for multiple buyers or subscriptions. There is no need for a driver, there is no downtime, and there is no intermediary involved.

Compare that to Uber or Lyft. They rely on third-party drivers and vehicles — all variable, all costly. Tesla removes the biggest expense in mobility: labor. That’s not competition. That’s elimination.

Vertical Integration: Tesla’s Hidden Advantage

Most people focus on Tesla’s cars. But the real edge lies in something far harder to replicate: vertical integration. While legacy automakers outsource software and tech firms try to bolt autonomy onto third-party hardware, Tesla owns the entire autonomy stack.

Tesla keeps everything in-house, from the car itself to its custom Dojo chip, the Full Self-Driving (FSD) software, and the billions of real-world miles that fuel its neural net. That’s the flywheel. And it’s already spinning.

Compare that to Waymo, technically brilliant but with a fraction of the fleet and no manufacturing muscle. Cruise? GM has backed Cruise, but public trust and safety issues have stalled its momentum. Apple? Apple has discreetly withdrawn from the market. Meanwhile, Tesla has 5 million cars on the road, all collecting data, all capable of receiving over-the-air updates, and many already monetized through paid FSD subscriptions.

This is not a project awaiting approval. The commercial rollout is already underway, and investors who still view this as speculative may be reconsidering their decision.

The FSD Milestone And What Comes Next

Tesla’s FSD v12 update didn’t just tweak the driving algorithm; it rewrote the stack. Gone is the old rules-based logic. In its place: a neural net trained end-to-end on real-world video, learning like a human and improving like a machine. The shift is exponential, not iterative, and that’s the inflection most investors still miss.

We saw the first real-world glimpse of this change a day ago, when Tesla launched its robotaxi pilot in Austin. A handful of driverless Model Ys quietly began taking riders, fully autonomous but monitored, at a symbolic $4.20 fare. There was no press release at the time. Just execution.

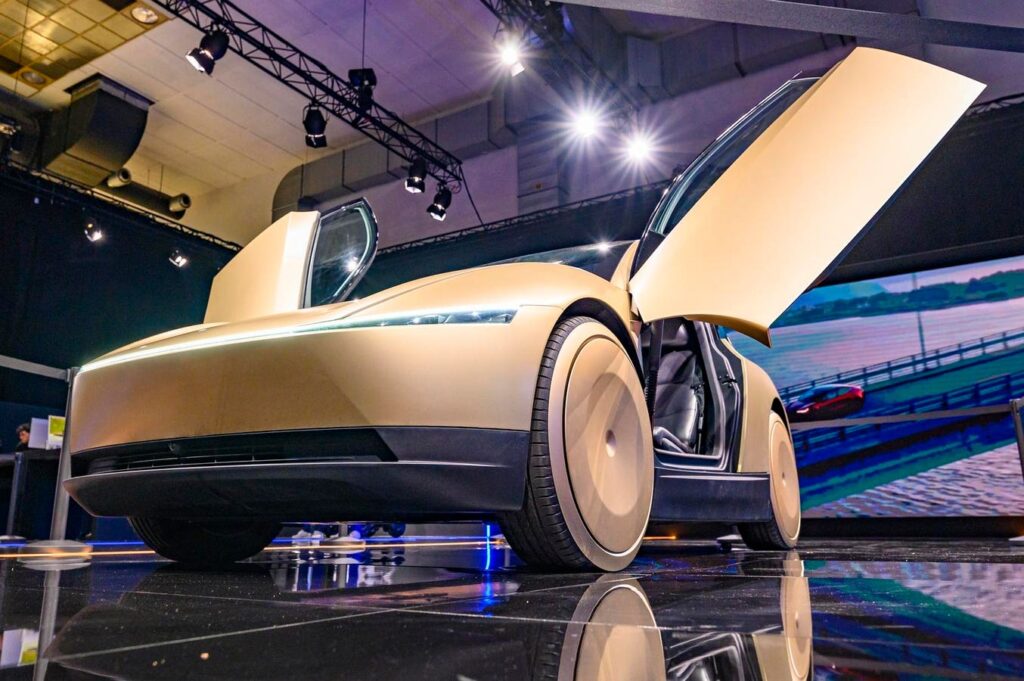

The real catalyst comes next: August 8, 2025, when Elon unveils the Cybercab, a steering-wheel-free, purpose-built autonomous vehicle designed for Tesla’s own ride-hailing network. This isn’t a concept. The hardware’s ready. The software’s learning. And the business model is recurring. Tesla isn’t just selling EVs anymore. It’s renting out the future, one mile at a time.

The Financial Reframe: How Analysts May Be Missing It

Most analysts still value Tesla as just another carmaker, projecting EBITDA based on unit sales, delivery growth, and gross margin per vehicle. But that lens misses the shift underway. Tesla isn’t just selling metal; it’s building a vertically integrated platform with software-like economics. Think of recurring revenue from robotaxis, not one-time car sales. Each autonomous vehicle could generate $10,000 to $15,000 per year, per car, at 70–80% margins. When multiplied across millions of units, this moves beyond the traditional Detroit territory. You are now in the realm of cloud software. Add Dojo, Tesla’s in-house AI training supercomputer, which serves internal purposes and creates a revenue model akin to a data center. Add the potential licensing of Full Self-Driving software to other OEMs, and what you get is an upside-distance scenario that doesn’t fit traditional comps.

Risk Factors And Realities

There is no guarantee of Tesla’s success. Even the most bullish investors need to recognize real hurdles. Regulatory approvals will roll out city by city, not all at once—and one high-profile robotaxi crash could dominate headlines and stall momentum. Public trust isn’t automatic either; convincing people to ride in driverless cars will take time. And competition is fierce: Waymo has elite tech, Amazon’s Zoox is quietly advancing, and China’s Baidu is pushing fast in its home market.

However, it’s crucial to note that none of these companies possess the same scale, brand recognition, or the vast data advantage derived from billions of real-world miles as Tesla. That matters. The path won’t be linear, but the opportunity is asymmetric. The market loves to overprice short-term noise and underprice long-term transformation. Investors who can stomach the bumps may end up owning a piece of mobility’s future infrastructure—not just a car stock.

Why Tesla’s Robotaxi Vision Can’t Be Ignored

Tesla’s robotaxi ambition extends beyond simply competing with Uber; it aims to revolutionize mobility, economics, and platform value. If it pulls this off, Tesla won’t simply be a carmaker. It becomes a software powerhouse, a data flywheel, and a ride-hailing juggernaut, all vertically integrated. That kind of optionality isn’t something traditional auto valuations can capture. You’re not buying Ford 2.0; you’re buying Apple transportation. Similar to previous significant changes, the market may not immediately recognize this shift. It’ll whisper. The company controlling the chip, the car, and the algorithm is poised to transform the game. game. Ignore it at your cost.

The author owns Tesla stock.

Read the full article here