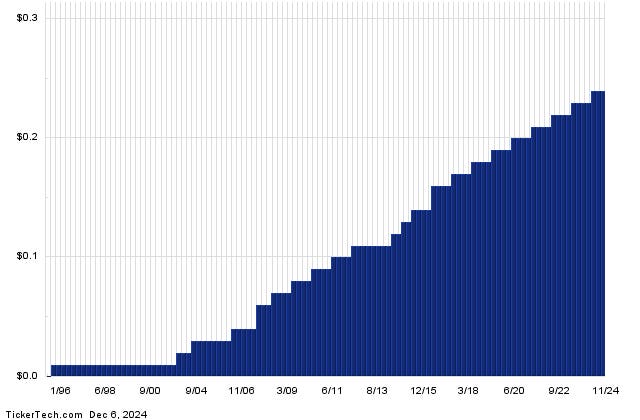

Flowers Foods, has been named to the Dividend Channel ”S.A.F.E. 25” list, signifying a stock with above-average ”DividendRank” statistics including a strong 4.3% yield, as well as a superb track record of at least two decades of dividend growth, according to the most recent ”DividendRank” report.

According to the ETF Finder at ETF Channel, Flowers Foods, Inc. is a member of the iShares S&P 1500 Index ETF (ITOT), and is also an underlying holding representing 0.26% of the SPDR S&P Dividend ETF (SDY), which holds $55,806,626 worth of FLO shares.

Flowers Foods made the “Dividend Channel S.A.F.E. 25” list because of these qualities: S. Solid return — hefty yield and strong DividendRank characteristics; A. Accelerating amount — consistent dividend increases over time; F. Flawless history — never a missed or lowered dividend; E. Enduring — at least two decades of dividend payments.

Top 25 S.A.F.E. Dividend Stocks Increasing Payments For Decades »

The annualized dividend paid by Flowers Foods, Inc. is $0.96/share, currently paid in quarterly installments, and its most recent dividend ex-date was on 11/29/2024. Below is a long-term dividend history chart for FLO, which the report stressed as being of key importance.

FLO operates in the Food & Beverage sector, among companies like Mondelez International, and Kraft Heinz.

Read the full article here