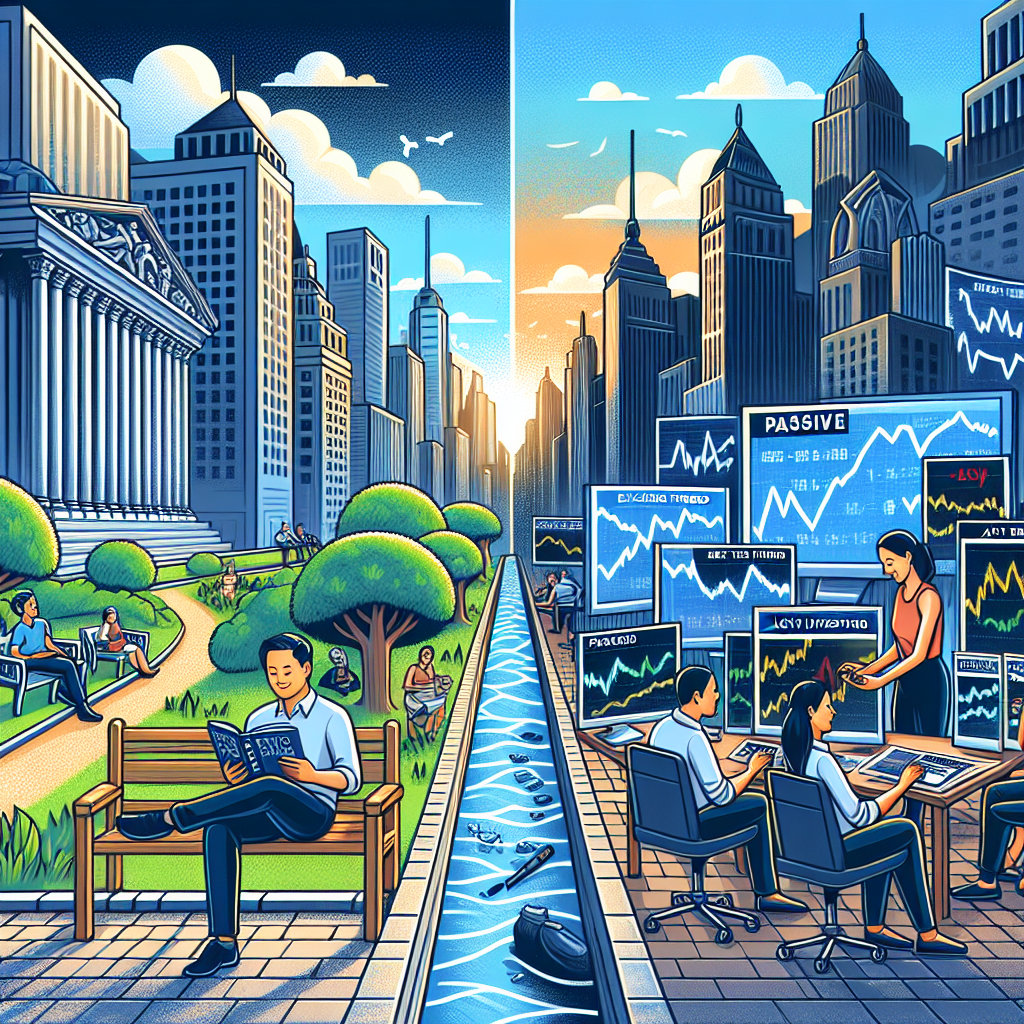

When it comes to investing, one of the most crucial decisions you will face is whether to adopt a passive or active investment strategy. Both methods have their merits and drawbacks, making it important for investors to assess their goals, risk tolerance, and time commitment. In this article, we will explore the differences between passive and active investing, the advantages and disadvantages of each approach, and how to choose the style that best suits your financial needs.

What is Passive Investing?

Passive investing is an investment strategy aimed at maximizing returns by minimizing buying and selling. This approach typically involves investing in index funds or exchange-traded funds (ETFs) that mirror a specific market index, such as the S&P 500. The goal is to achieve returns that are in line with the overall market performance.

Key Characteristics of Passive Investing

- Low Costs: Since passive investment strategies typically involve less frequent trading, management fees tend to be lower.

- Long-Term Focus: Passive investors generally adopt a buy-and-hold strategy, which aligns with long-term financial goals.

- Market Efficiency: Passive investing operates on the assumption that markets are efficient, meaning that it’s difficult to consistently outperform them.

What is Active Investing?

Active investing, on the other hand, entails actively buying and selling securities in an attempt to outperform the market. This strategy requires a hands-on approach, with investors or their fund managers constantly analyzing market conditions, economic trends, and individual securities.

Key Characteristics of Active Investing

- Potential for Higher Returns: Active investors aim to capitalize on short-term price fluctuations and may achieve higher returns if their strategies prove successful.

- Increased Research and Analysis: Active investing requires in-depth research and knowledge of market trends, sectors, and individual companies.

- Higher Costs: Due to the frequent trading and management oversight involved, active investment strategies typically incur higher fees.

Advantages of Passive Investing

1. Cost Efficiency

One of the standout benefits of passive investing is the cost-effectiveness. With lower management fees and reduced trading costs, passive investors can retain more of their returns over time.

2. Simplicity and Convenience

For individuals new to investing, passive strategies offer a simpler and less time-consuming approach. With fewer decisions to make, investors can allocate their funds and forget about them, allowing for a more hands-off experience.

3. Consistent Performance

Research has shown that, over the long term, many actively managed funds fail to outperform their benchmark indexes. Passive investing may provide more predictable and consistent results in line with market averages.

Disadvantages of Passive Investing

1. Limited Flexibility

Passive investors are unable to react quickly to market changes. If the market takes a downturn, a passive strategy may lead to losses without any means of protection.

2. Market Underperformance

In certain market conditions, such as during economic downturns or periods of volatility, passive investing can lead to subpar returns if the index reflects a decline.

Advantages of Active Investing

1. Potential to Outperform the Market

The primary allure of active investing is the potential for higher returns. Skilled portfolio managers may leverage their expertise to capitalize on mispriced securities and other market inefficiencies.

2. Strategic Flexibility

Active investors can quickly adjust their portfolios in response to market dynamics, allowing them to safeguard their investments during downturns or capitalize on emerging opportunities.

3. Personalized Investment Strategies

Active investing allows for a more tailored approach to individual financial goals. Investors can focus on specific sectors, growth stocks, or value opportunities that match their risk tolerance and objectives.

Disadvantages of Active Investing

1. Higher Costs

Active investing typically incurs greater fees, including management fees and trading costs, which can eat into returns over time. This is a crucial consideration for many long-term investors.

2. Time-Intensive

Active investing requires significant research, monitoring, and analysis. For investors with limited time or expertise, this might prove challenging and lead to suboptimal results.

3. Risk of Underperformance

Despite the potential for higher returns, not all active managers outperform their benchmarks. Some may incur losses due to poor market timing or inadequate research.

How to Choose Your Ideal Investment Style

Selecting between passive and active investing should ultimately align with your financial goals, risk tolerance, and knowledge level. Here are a few factors to consider:

1. Assess Your Goals and Time Horizon

If you are investing for long-term goals, like retirement, and prefer a hands-off approach, passive investing may be more suitable. Conversely, if you are looking for short-term gains and actively want to manage your portfolio, active investing might be the better fit.

2. Understand Your Risk Tolerance

Consider how much risk you are willing to take. Active investing may involve higher highs but also lower lows, while passive strategies typically reflect market averages.

3. Assess Your Knowledge and Commitment Level

Evaluate your understanding of the market and your commitment to maintaining an investment strategy. If you’re not willing to engage with the complexities of active management, passive investing may ease your journey.

Conclusion

Deciding between passive and active investing requires careful consideration of your financial situation, risk appetite, and investment goals. There is no one-size-fits-all strategy; what matters most is finding an investment style that suits your needs and allows you to work towards your financial objectives. Whether you choose a passive or active approach, the key is to remain informed and adaptable to the ever-changing financial landscape.