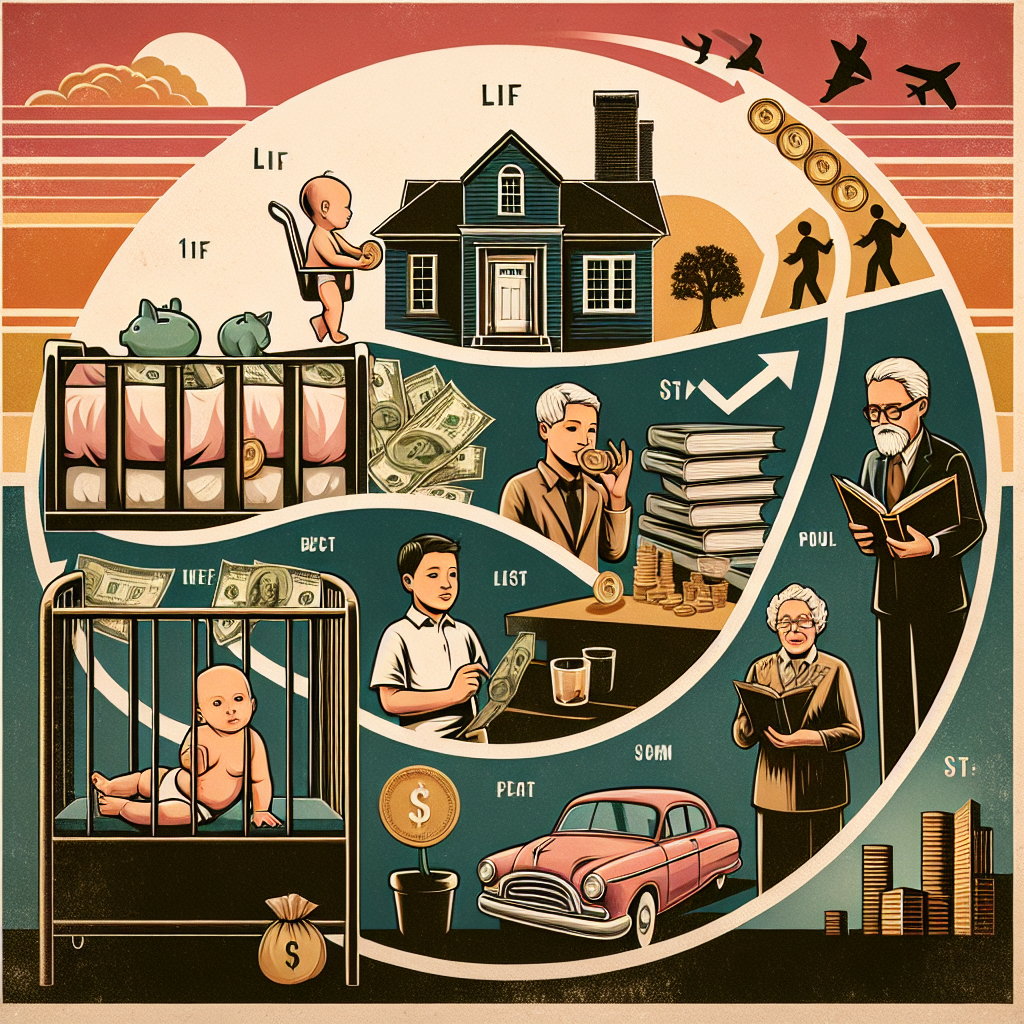

Financial planning is a crucial aspect of securing a stable and prosperous future. Regardless of your age or income level, mastering your money can lead to peace of mind and financial freedom. In this article, we will explore essential financial planning tips tailored for every stage of life, from young adulthood to retirement.

1. Financial Planning in Your 20s: Building a Strong Foundation

Start Budgeting Early

Creating a budget is one of the most important financial planning tips for your 20s. Start tracking your income and expenses to understand where your money goes. Use budgeting apps or spreadsheets to visualize your spending habits and make informed decisions on how to allocate your funds effectively.

Build an Emergency Fund

One major financial goal in your 20s should be to establish an emergency fund. Aim to save at least three to six months’ worth of living expenses in a high-yield savings account. This fund will provide a financial safety net against unforeseen circumstances, such as medical emergencies or job loss.

Begin Investing for the Future

Start investing in your 20s to take advantage of compound interest. Contribute to retirement accounts like a 401(k) or an IRA, especially if your employer offers a matching contribution. The earlier you start, the more your money will grow over time.

2. Financial Planning in Your 30s: Growing Your Wealth

Increase Your Savings Rate

In your 30s, career advancements and potential salary increases can provide an opportunity to boost your savings rate. Aim to save at least 20% of your income. Consider automating your savings to ensure consistency.

Diversify Your Investment Portfolio

As your income grows, it’s essential to diversify your investments to mitigate risks. Research different investment vehicles, including stocks, bonds, real estate, and mutual funds. A diversified portfolio can lead to better returns while minimizing losses.

Review and Adjust Your Insurance

Life changes, such as marriage or starting a family, may require you to reassess your insurance needs. Review your health, auto, life, and disability insurance policies to ensure you have adequate coverage for your new circumstances.

3. Financial Planning in Your 40s: Focusing on Growth and Stability

Maximize Retirement Contributions

By your 40s, it’s time to focus on retirement planning aggressively. Take full advantage of your employer’s retirement plans by maximizing your contributions. If you haven’t already, consider opening a Roth IRA for tax-free growth.

Plan for Your Children’s Education

If you have children, it’s crucial to start planning for their education expenses. Explore 529 college savings plans, which offer tax advantages for educational savings. The earlier you start saving, the more you can accumulate through compound growth.

Develop a Comprehensive Estate Plan

In your 40s, it’s wise to start thinking about your estate plan. Create or update your will, establish powers of attorney, and consider setting up trusts to protect your assets. Estate planning can ensure that your wishes are honored and reduce the financial burden on your loved ones.

4. Financial Planning in Your 50s: Preparing for Retirement

Evaluate Your Retirement Goals

Assess your retirement goals and how much you need to save to maintain your desired lifestyle. Use retirement calculators to project how much you’ll need and evaluate if your current savings are on track. Consider working with a financial advisor for personalized advice.

Pay Off Debt

Focus on reducing or eliminating debt as you approach retirement. High-interest debts, such as credit cards and personal loans, can hinder your ability to save for retirement. Consider debt repayment strategies, like the snowball or avalanche method, to become debt-free.

Rebalance Your Investment Portfolio

As you near retirement, adapting your investment strategy is crucial. Shift your asset allocation to reduce risk and protect your savings. Rebalance your portfolio periodically to align with your evolving retirement goals and risk tolerance.

5. Financial Planning in Your 60s and Beyond: Enjoying Retirement

Develop a Withdrawal Strategy

In retirement, it’s essential to have a withdrawal strategy that preserves your savings while allowing you to enjoy your lifestyle. Consider the 4% rule, which suggests withdrawing 4% of your savings annually, adjusted for inflation. Tailor your withdrawal strategy based on your individual financial situation.

Consider Healthcare Costs

Healthcare expenses can significantly impact your retirement budget. Research Medicare and supplemental insurance plans, and consider long-term care insurance to protect your savings against unexpected medical costs.

Continue Engaging with Your Finances

Even in retirement, it’s important to stay engaged with your finances. Regularly review your budget, expenses, and investment performance to ensure your financial plan aligns with your needs.

Conclusion: Take Control of Your Financial Future

Mastering your money is a lifelong journey that requires commitment and adaptability. By implementing these essential financial planning tips at every stage of life, you can build a solid foundation for your financial future. Whether you’re just starting out in your 20s or enjoying retirement, proactive financial management can lead to peace of mind and a secure, fulfilling life. Remember, it’s never too late to start planning for your financial future!